📖 Multiplicity of Equilibria in Static Games#

⏱ | words

Practical task 7.1 Practical task 7.2 Practical task 7.3 References

Simple static game of incomplete information with multiple equilibria#

Main paper:

📖 Su [2014] “Estimating discrete-choice games of incomplete information: Simple static examples”

✝︎ Che-Lin Su, 1974-2015, Associate Professor of Operations Management at the University of Chicago Booth School of Business

Today:

Investigation into multiplicity of equilibria using a simple example

Practical implementation of a solver for multiple equilibria

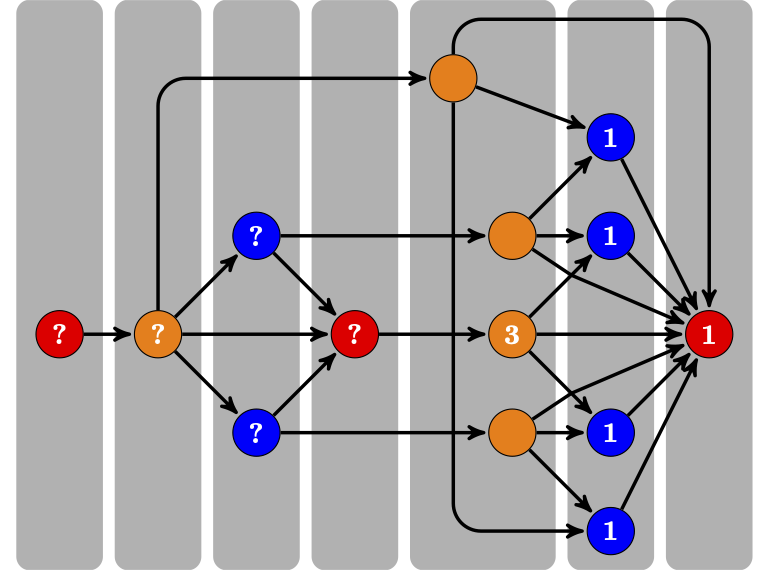

Example: static entry game#

Two firms: \(a\) and \(b\)

Actions: each firm has two possible actions:

Simultanenous entry decisions in the beginning \(\impliedby\) static game

Utility = payoffs to the firms

\(x=(x_a, x_b)\): firms’ observed types, common knowledge

\(\theta=(\alpha, \beta)\): structural parameters to be estimated

\(\varepsilon = (\varepsilon_a,\varepsilon_b)=(\varepsilon_{a0},\varepsilon_{a1},\varepsilon_{b0},\varepsilon_{b1})\): firms’ unobserved types, private information

\(\varepsilon\) are observed only by each firm, not by the opponent nor the econometrician \(\implies\) game of incomplete information \(\implies\) Bayesian Nash equilibrium (BNE), CCPs in focus of the solution method

Let beliefs of the other firm’s action be given by \(p_a = Pr\{d_a =1\}\), \(p_b = Pr\{d_b =1\}\) \(\iff\) CCPs in the equilibrium will be given by \(p^*_a\) and \(p^*_b\), with beliefs consistent with behavior

Expected (with respect to beliefs about the other player) profits are

Assume the error terms \((\varepsilon_{a0},\varepsilon_{a1},\varepsilon_{b0},\varepsilon_{b1})\) are iid across firms and alternatives, centralized and normalized EV1 distribution

Choice probabilities are then given by

Define the equilibrium mapping

Definition

A Bayesian-Nash equilibrium is given by a pair of CCPs of the players which constitutes mutual best responses to each others’ strategies. Thus, the equilibrium CCPs given by \((p^*_a,p^*_b)\) satisfy the fixed point equation

Existence of BNE? Multiplicity of BNE?

Solving for equilibria#

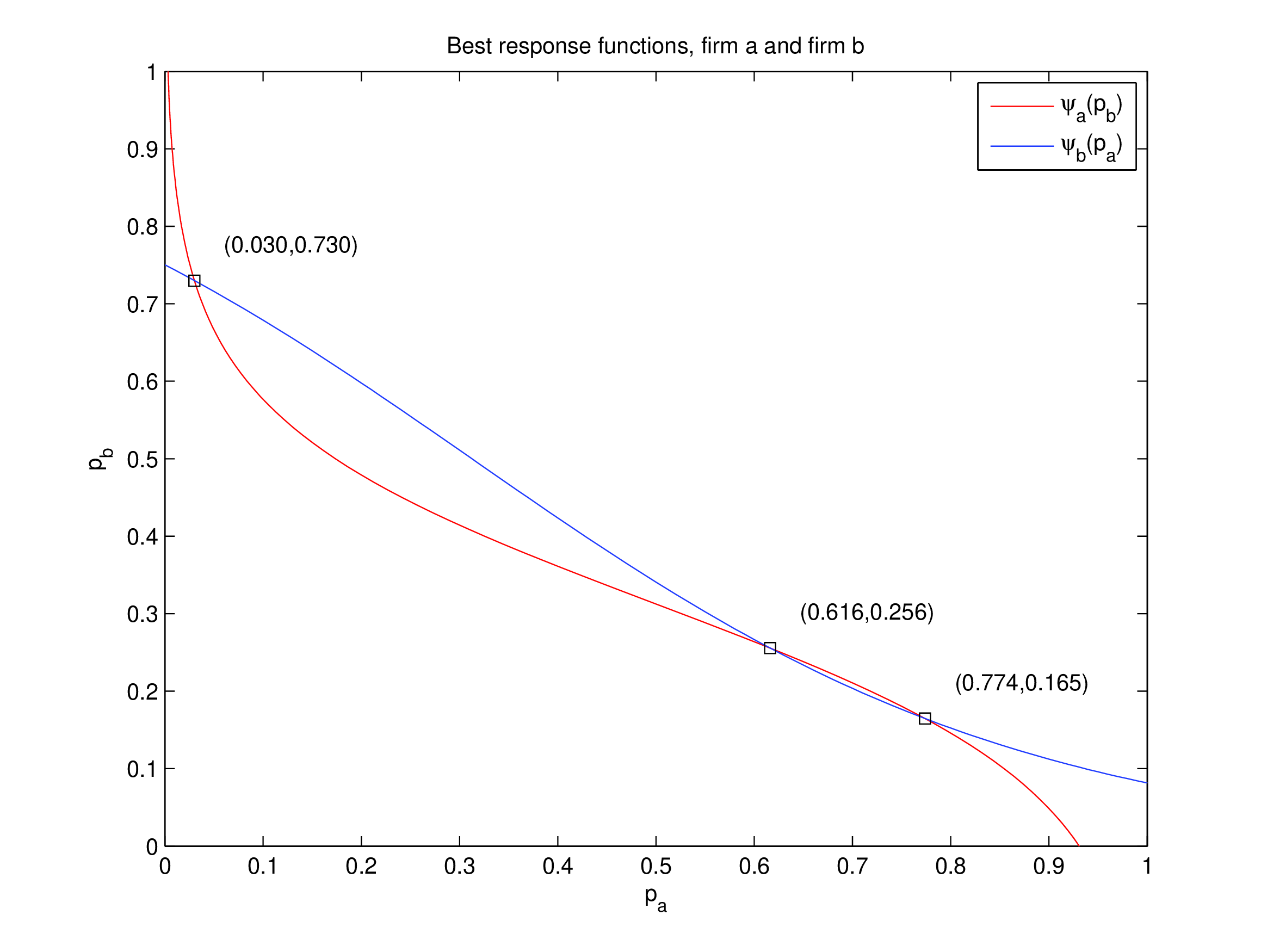

Parameterization#

We consider a very contestable game throughout:

Monopoly profits: \(\alpha x_{j}=5x_{j}\)

Duopoly profits: \(\beta x_{j}=-11x_{j}\)

Firm types: \((x_a ,x_b) = (0.52, 0.22)\)

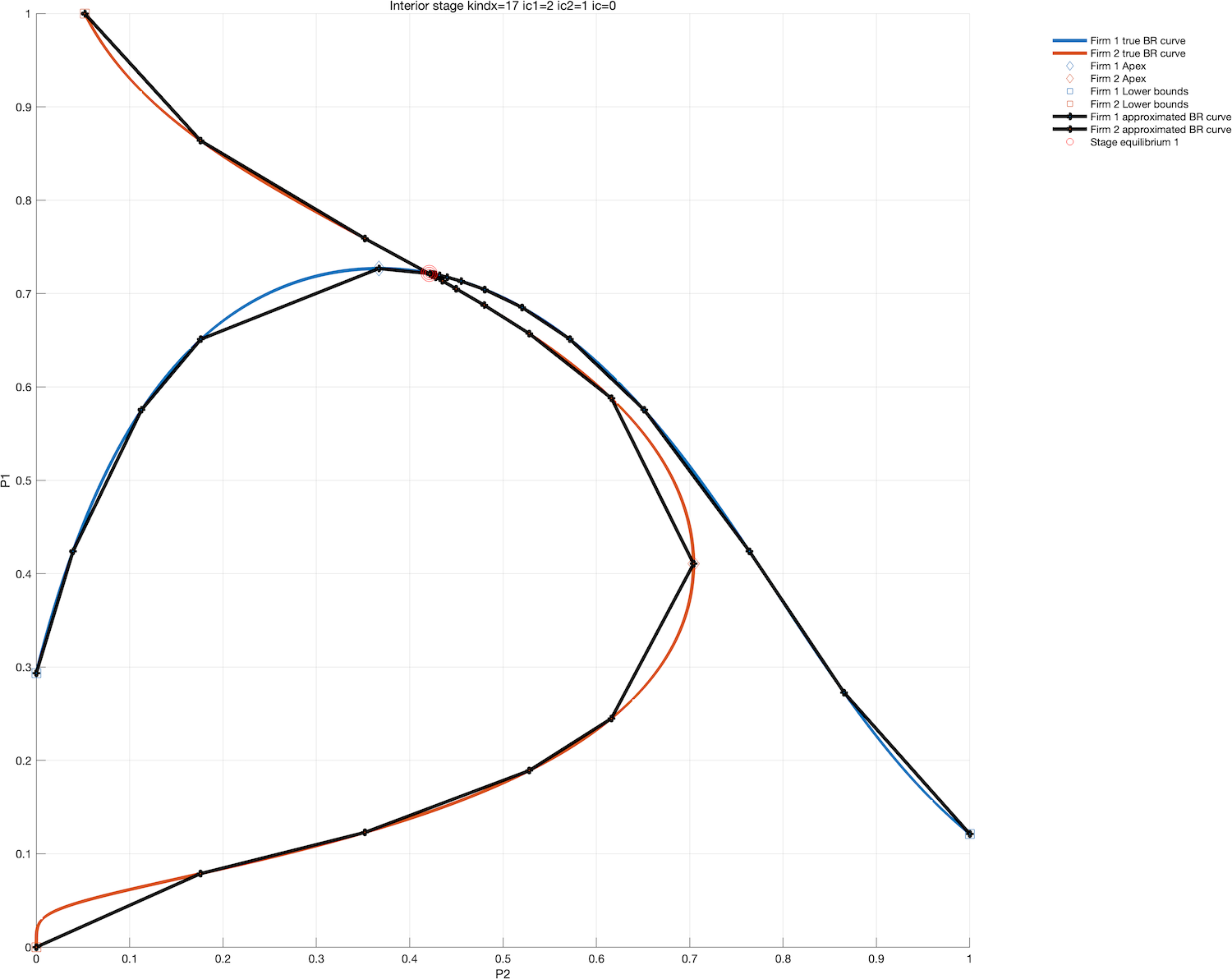

Solution approach 1#

equilibria are intersections of best response functions

Three equilibria!!!

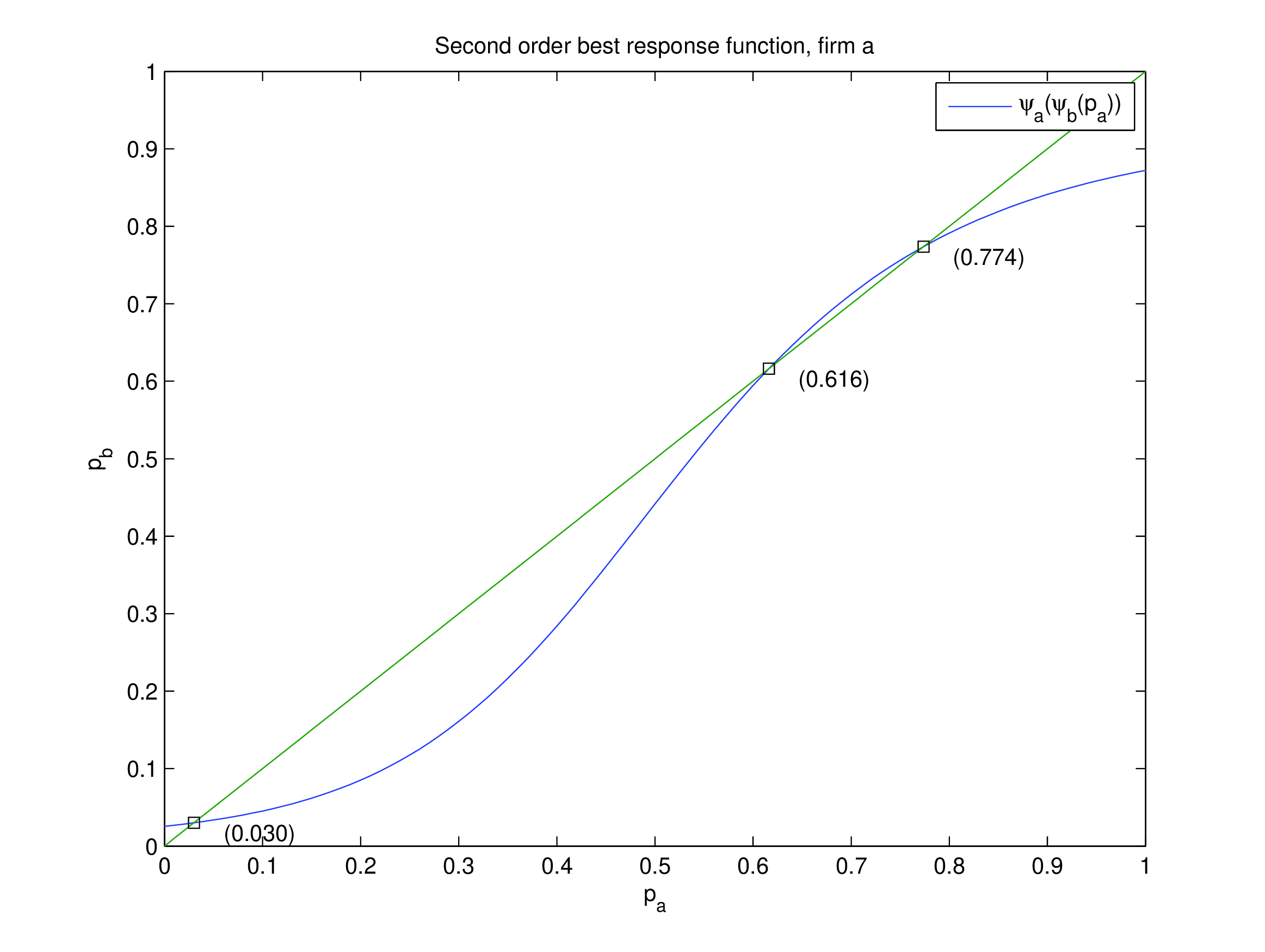

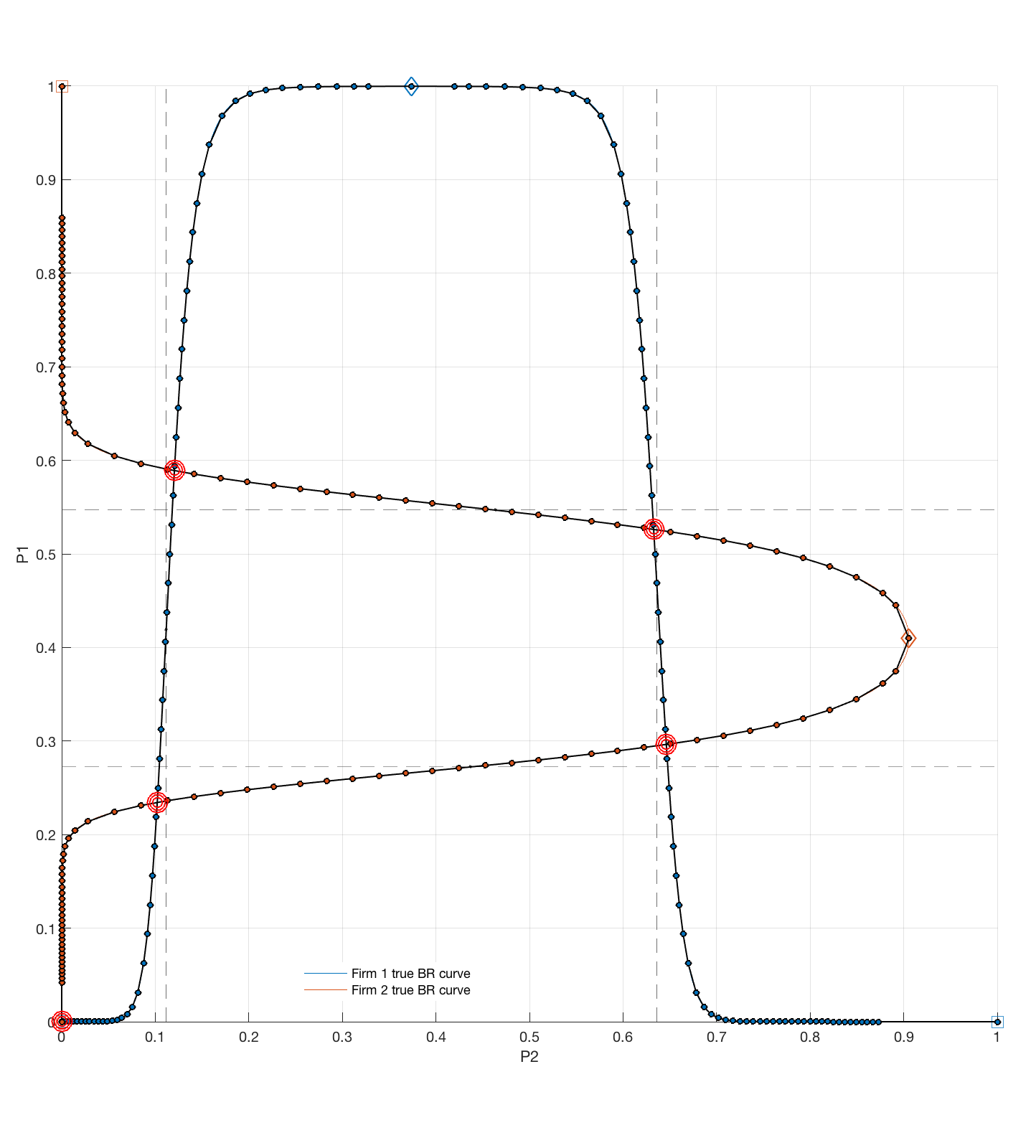

Solution approach 2#

equilibria as fixed point of second-order best response function

Second-order best response function

How to solve to find all equilibria?#

No absolutely guaranteed method to find all equilibria

Poly-algorithm is a good idea

Approximation is a good idea

Adaptive update of the solution to increase accuracy is a good idea

Combination of successive approximations and the bisection algorithm.#

Successive approximations (SA)

Converges to the nearest stable equilibrium.

Start SA at \(p_{a}=0\) and \(p_{a}=1\).

Unique equilibrium (\(K=1\)): SA converges from anywhere.

Three equilibria (\(K=3\)): two stable, one unstable.

More equilibria (\(K>3\)): not in this model.

Bisection method

Use to find the unstable equilibrium when \(K=3\).

Repeatedly bisect an interval and select the subinterval where the fixed point/root lies.

The two stable equilibria define the initial search interval.

Very simple and robust, but relatively slow.

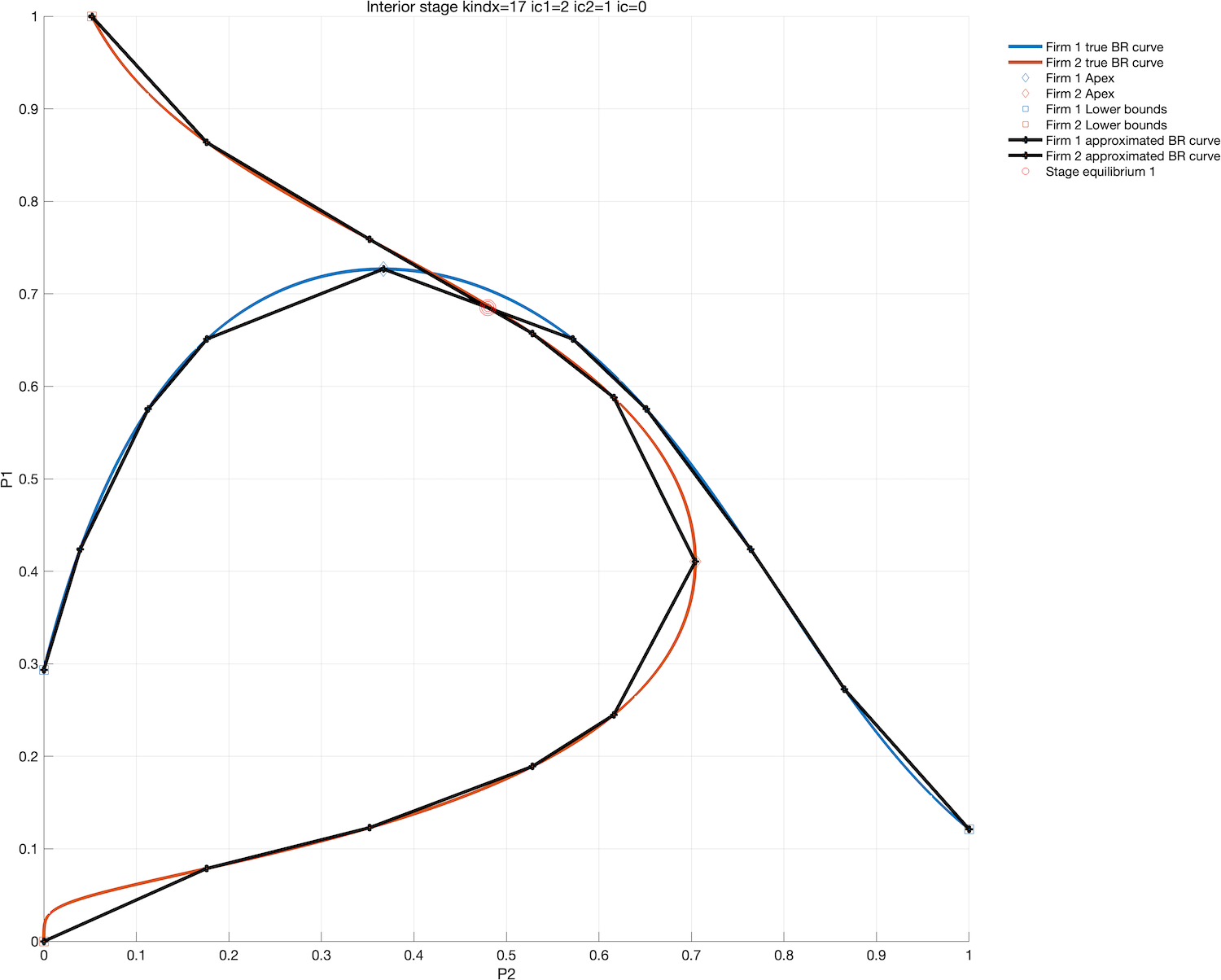

Piecewise linear approximations#

simple idea of approximating best response curves by piecewise linear functions

how many segments?

adoptive procedure is always a good idea!

make a sequential refinement procedure

the difference between current and previous step gives a measure of the approximation error

perform another step until the error is smaller than preset tolerance level

can handle arbitrary complex best response functions

any number of regular equilibria

numerical stability issues when best responses close to 0 or 1, which happens often

Practical Task 7.1

Study the implementing Su(2014) static model

Play with the model

Test the limits of the fixed point solver

Find the exercise code and materials in the exercises repo in the forlder 7_multiplicity

Practical Task 7.2

Study the implementation of piecewise linear approximations in class

polylineWatch the development of polyline class in a video from my CompEcon course

Code up a solver based on polylines, with adaptive refinement [optional]

Compare the accuracy of the solution to the fixed point solver

Find the exercise code and materials in the exercises repo in the forlder 7_multiplicity

Structural Estimation#

Data Generating Process (DGP): the data are generated by a single equilibrium

The two players play the same equilibrium 1000 times

Observed characteristics of the players are fixed at \((x_a ,x_b)=(0.52,0.22)\)

Data: \(X=\{d_a^i ,d_b^i\}_{i=1}^{1000}\)

True parameters: \(\theta=(\alpha_{0},\beta_{0})=(5,-11)\)

Given data \(X\), we want to recover structural parameters \(\alpha\) and \(\beta\)

Static Game Example: Maximum Likelihood Estimation#

Maximize the likelihood function:

\(p_{a}(\alpha,\beta)\) and \(p_{b}(\alpha,\beta)\) solve the BNE equations:

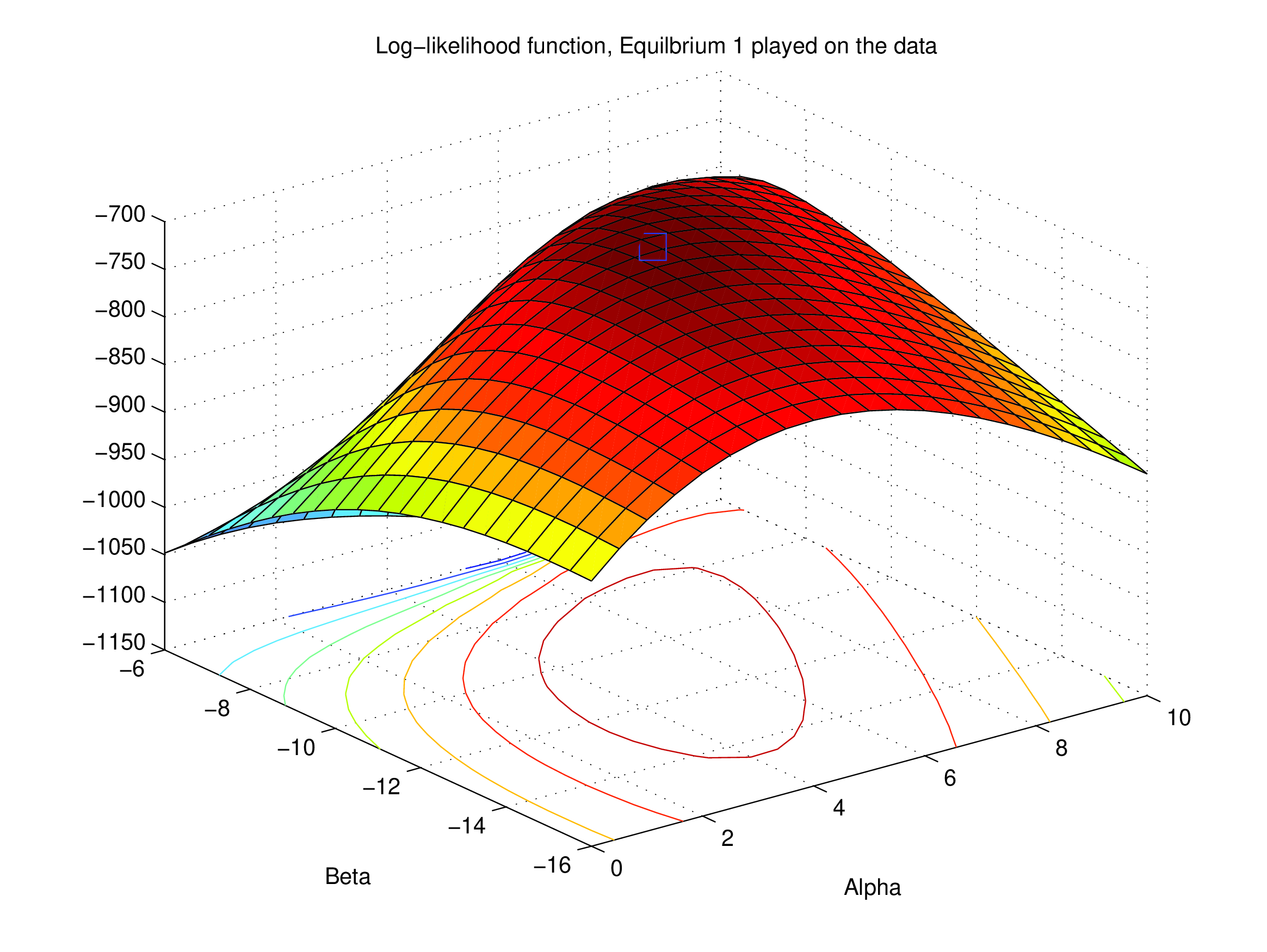

MLE with nested full solution method (NFXP)#

Outer loop

Choose \((\alpha,\beta)\) to maximize the likelihood

Inner loop

For a given \((\alpha,\beta)\), solve the BNE equations for all equilibria:

Choose the equilibrium with the highest likelihood:

and set

NFXP’s Likelihood as a Function of \((\alpha,\beta)\) — Eq 1#

Data generated from equilibrium 1

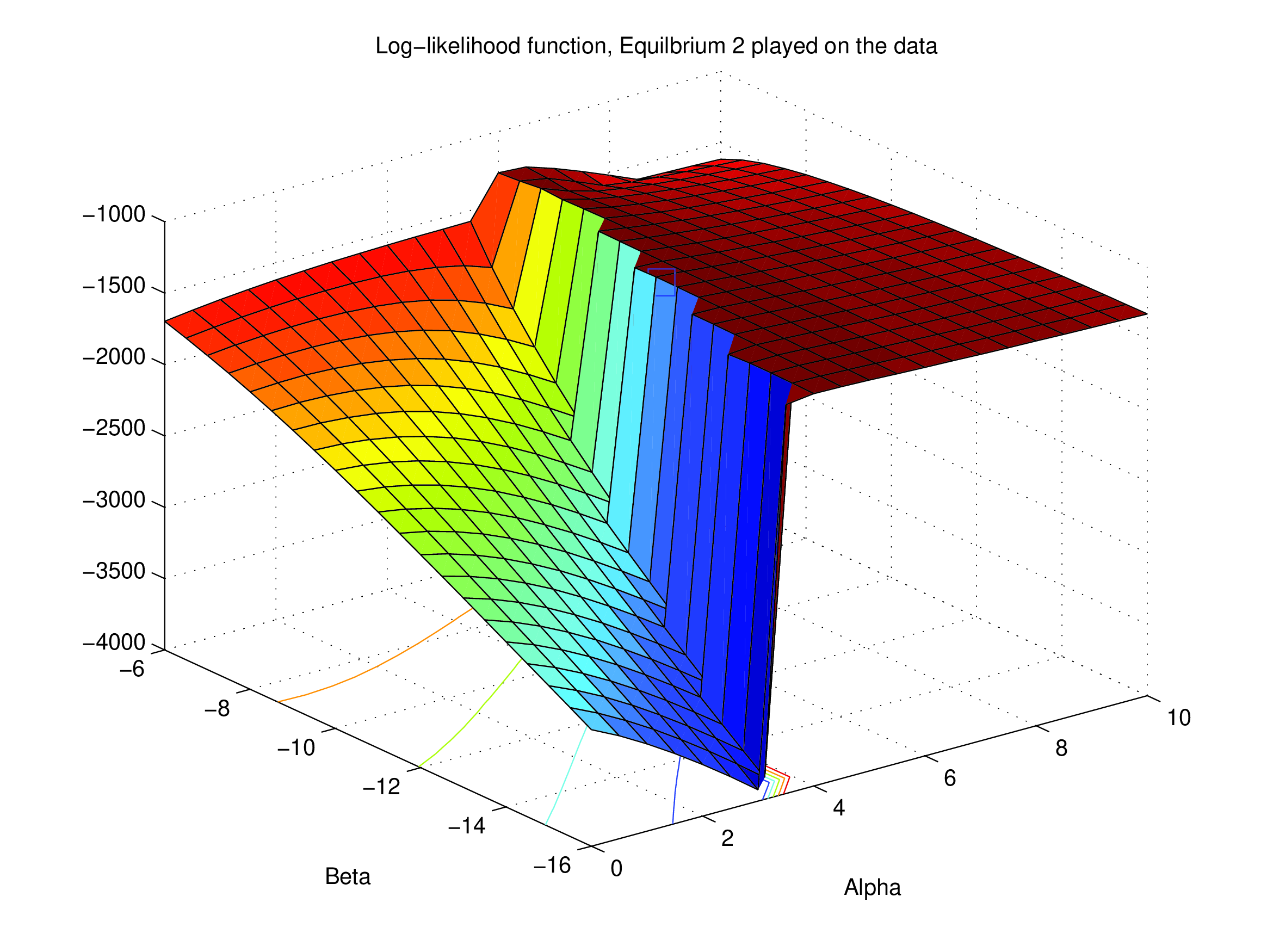

NFXP’s Likelihood as a Function of \((\alpha,\beta)\) — Eq 2#

Data generated from equilibrium 2

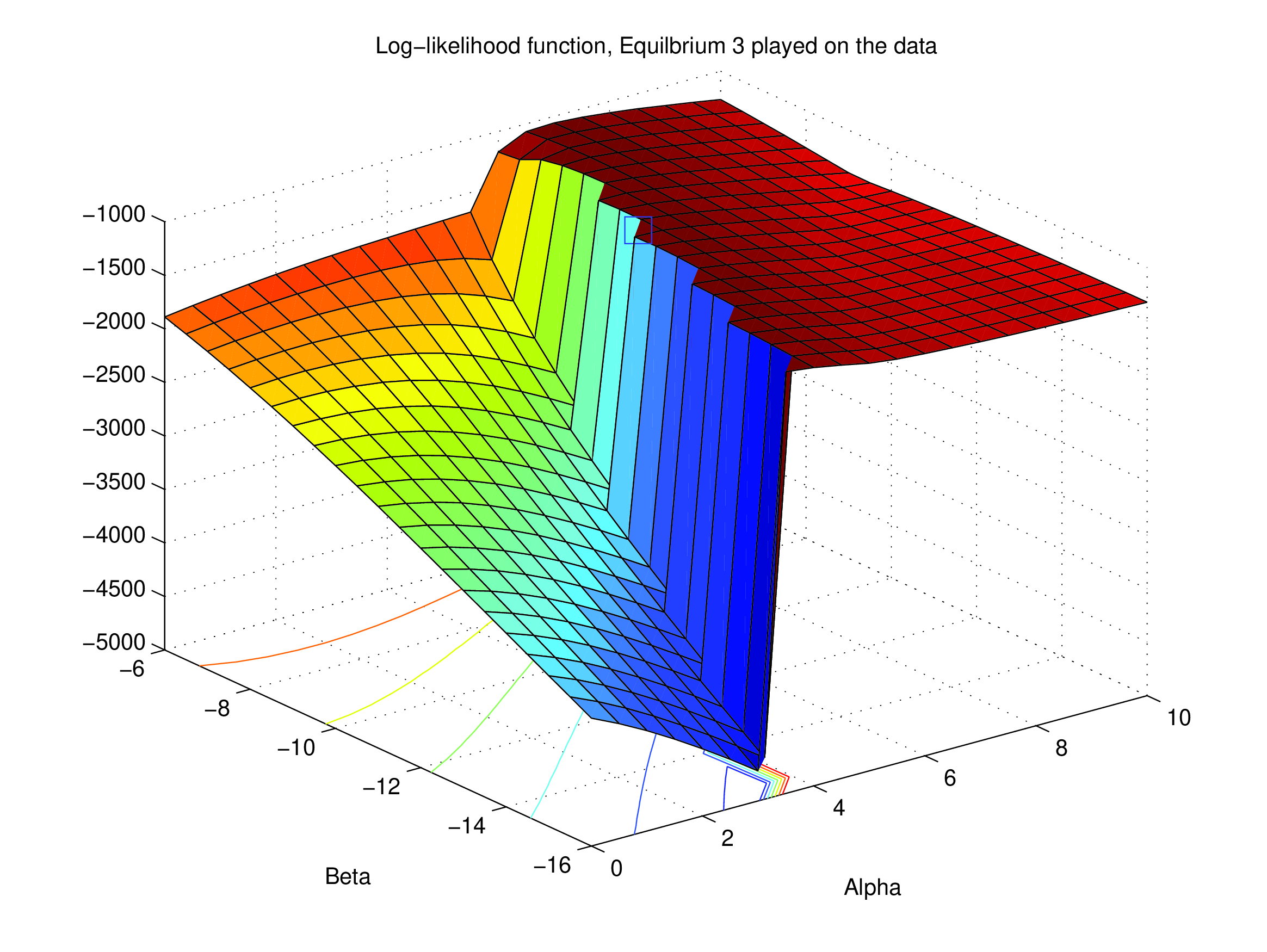

NFXP’s Likelihood as a Function of \((\alpha,\beta)\) — Eq 3#

Data generated from equilibrium 3

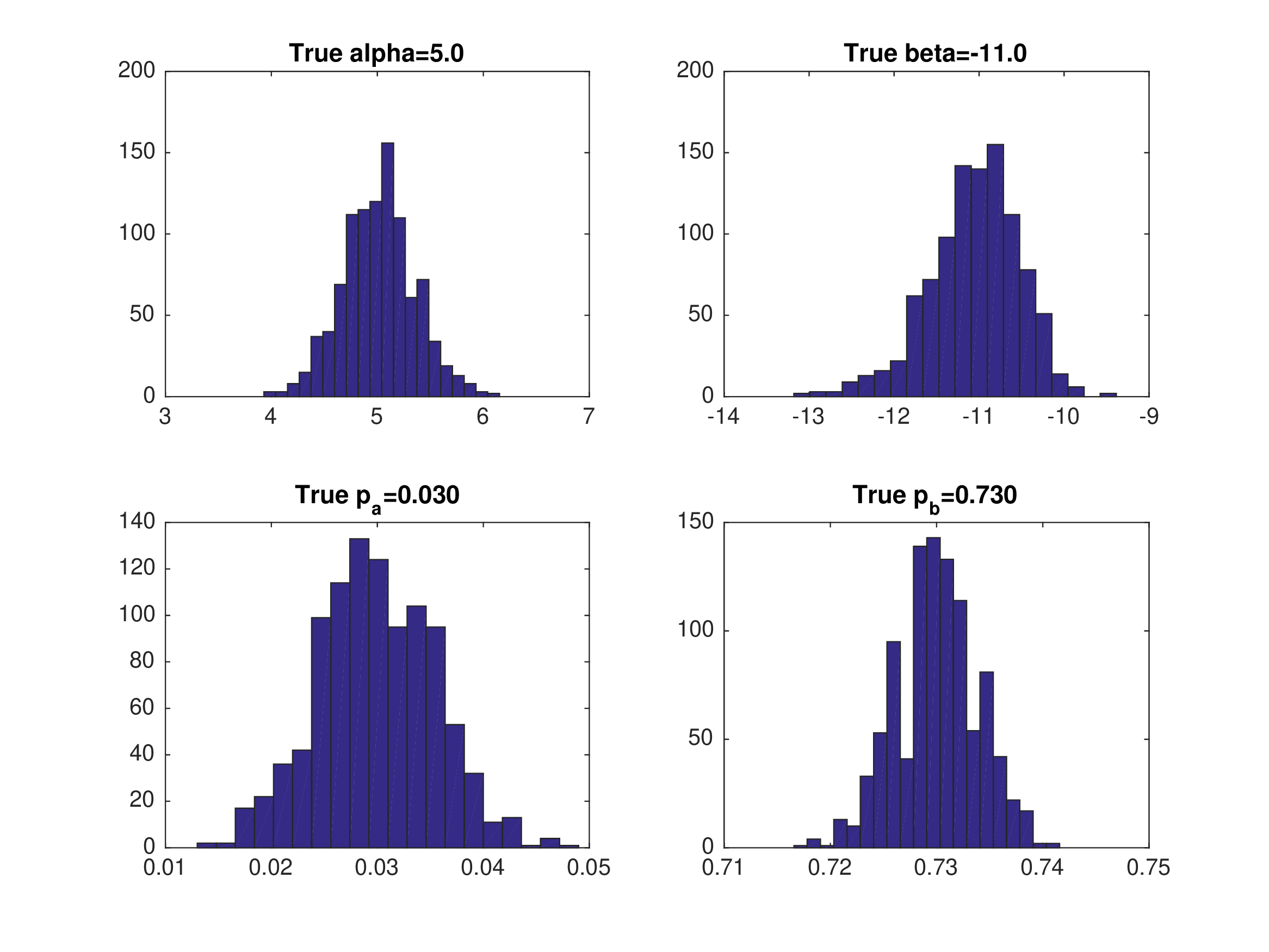

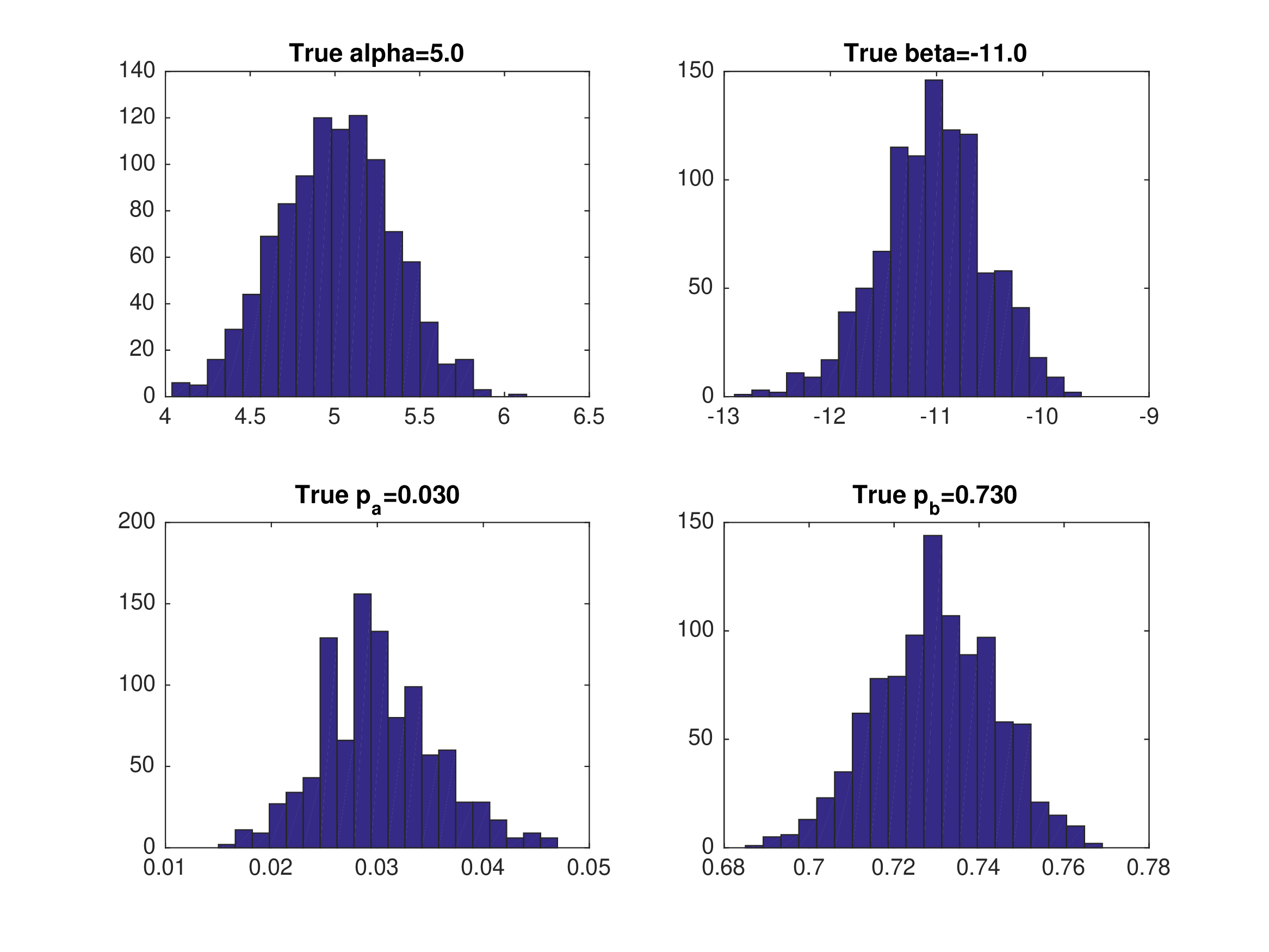

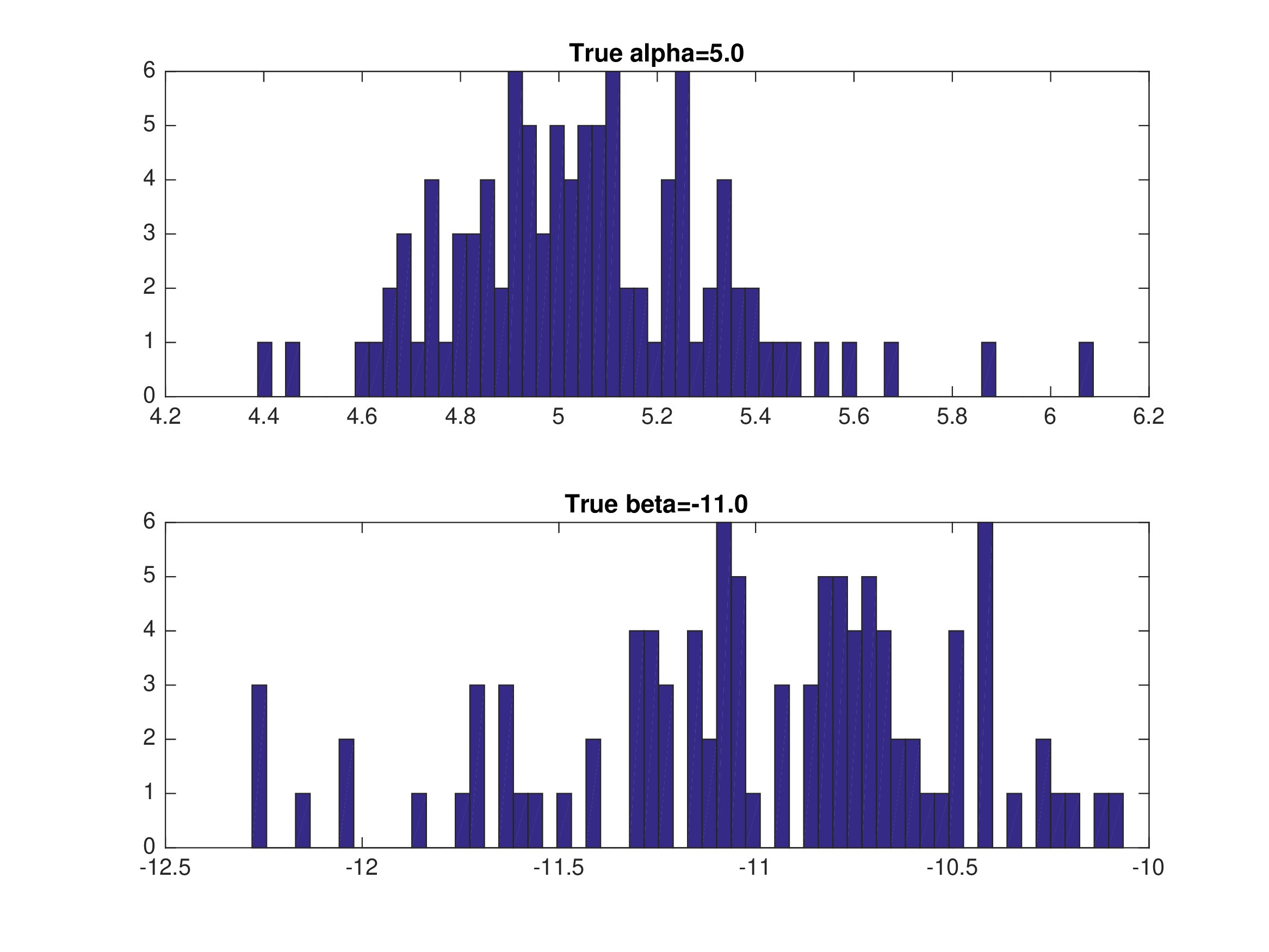

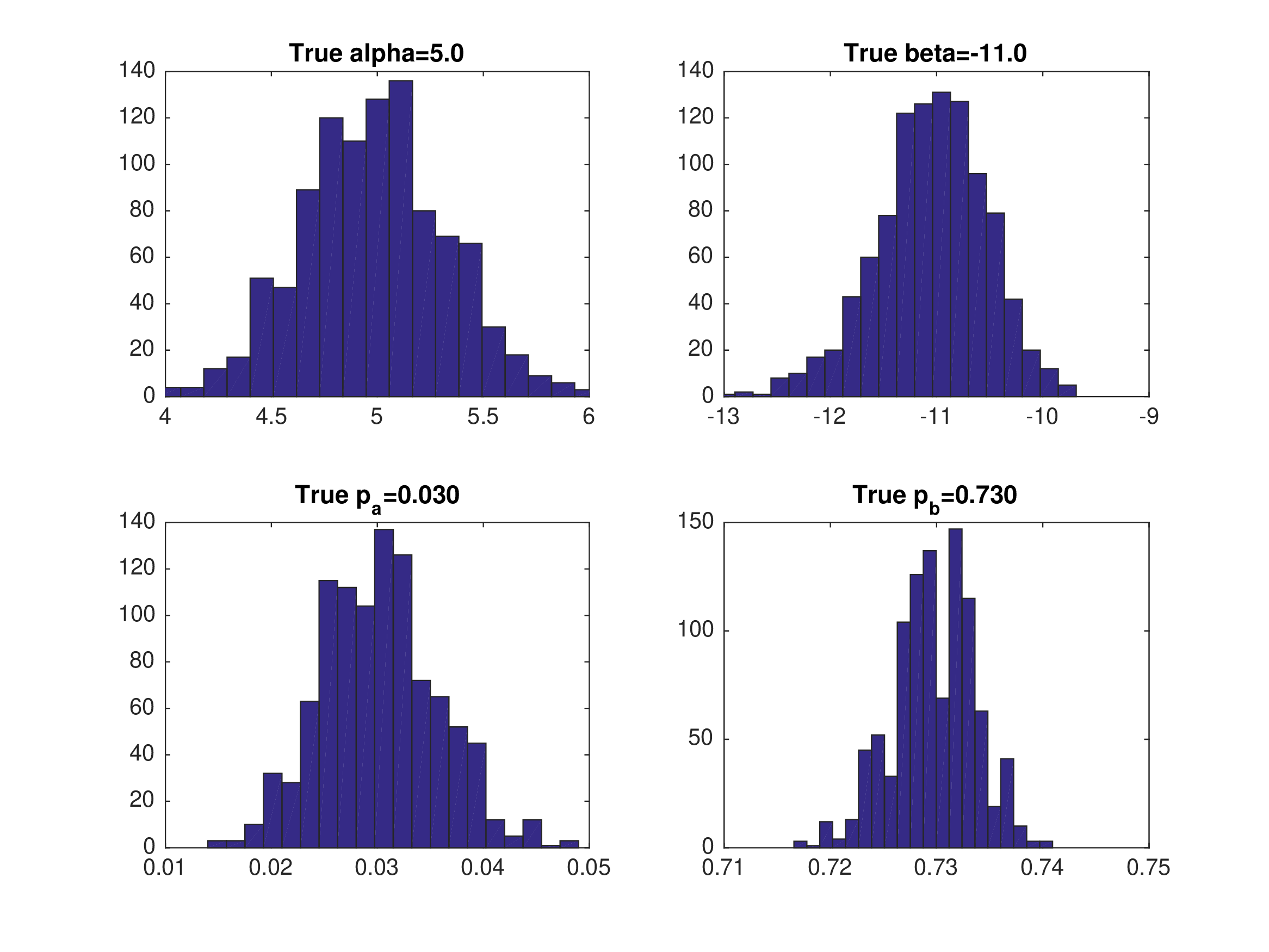

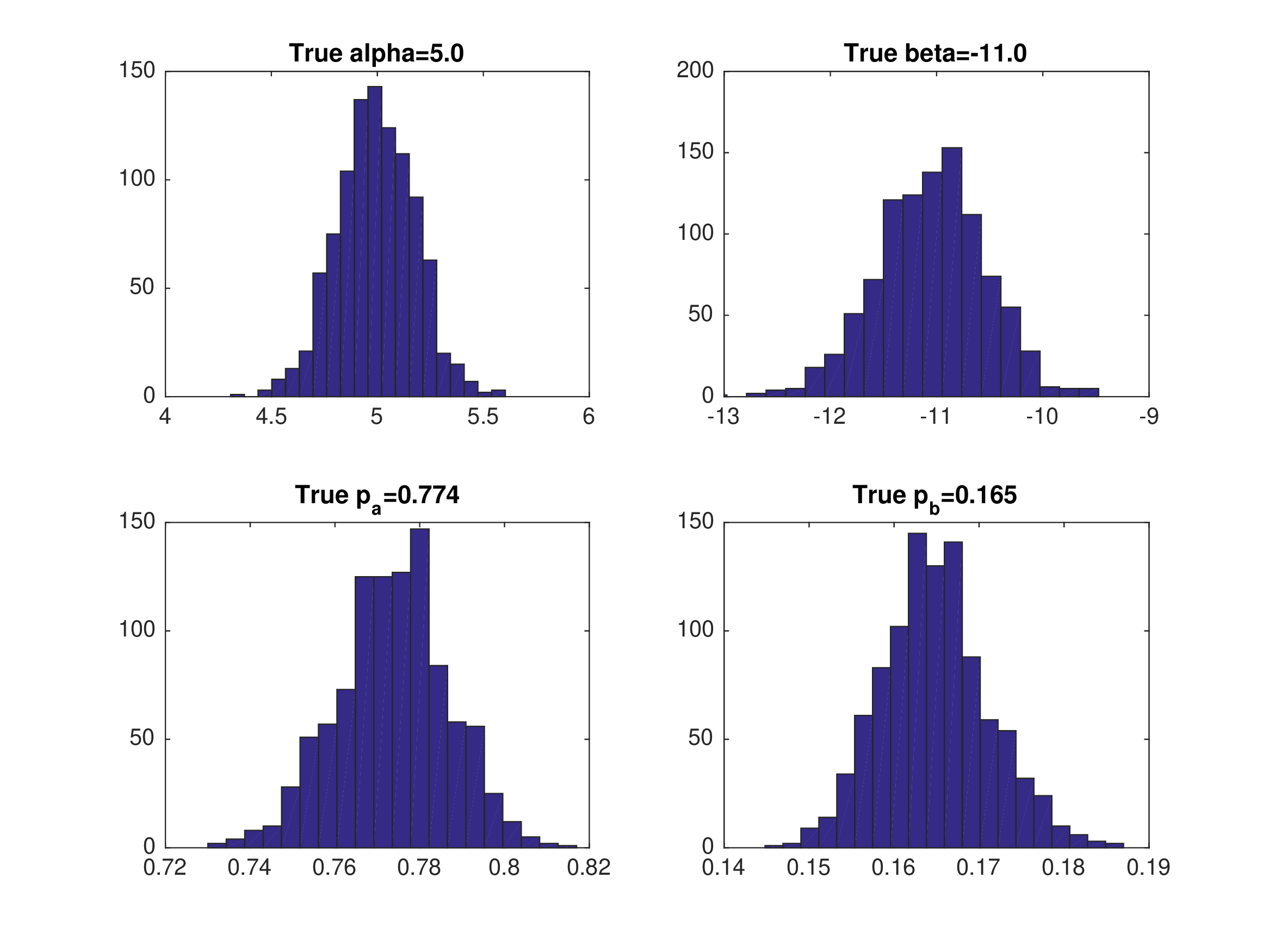

Monte Carlo Results: NFXP with Eq1#

Data generated from equilibrium 1

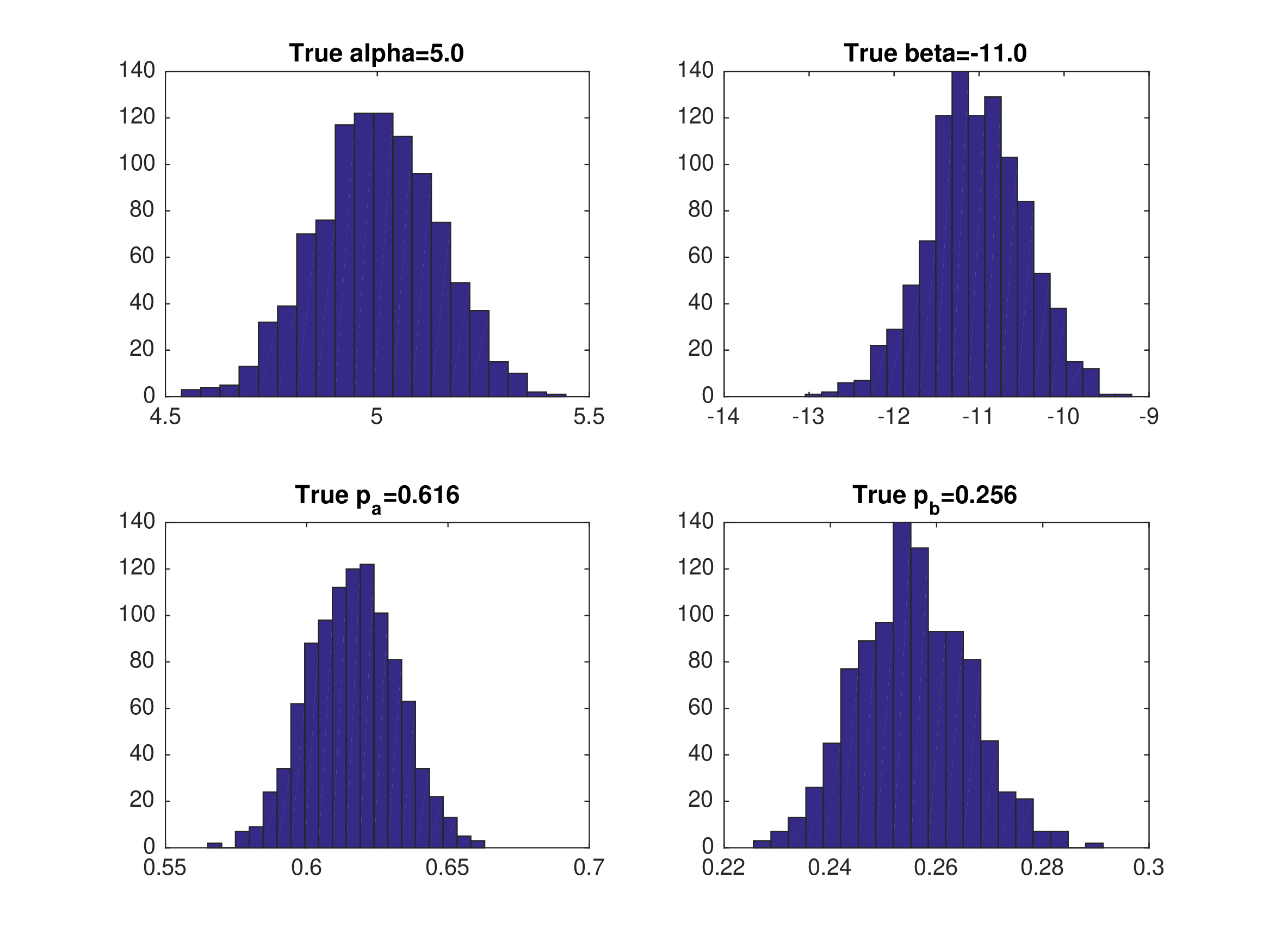

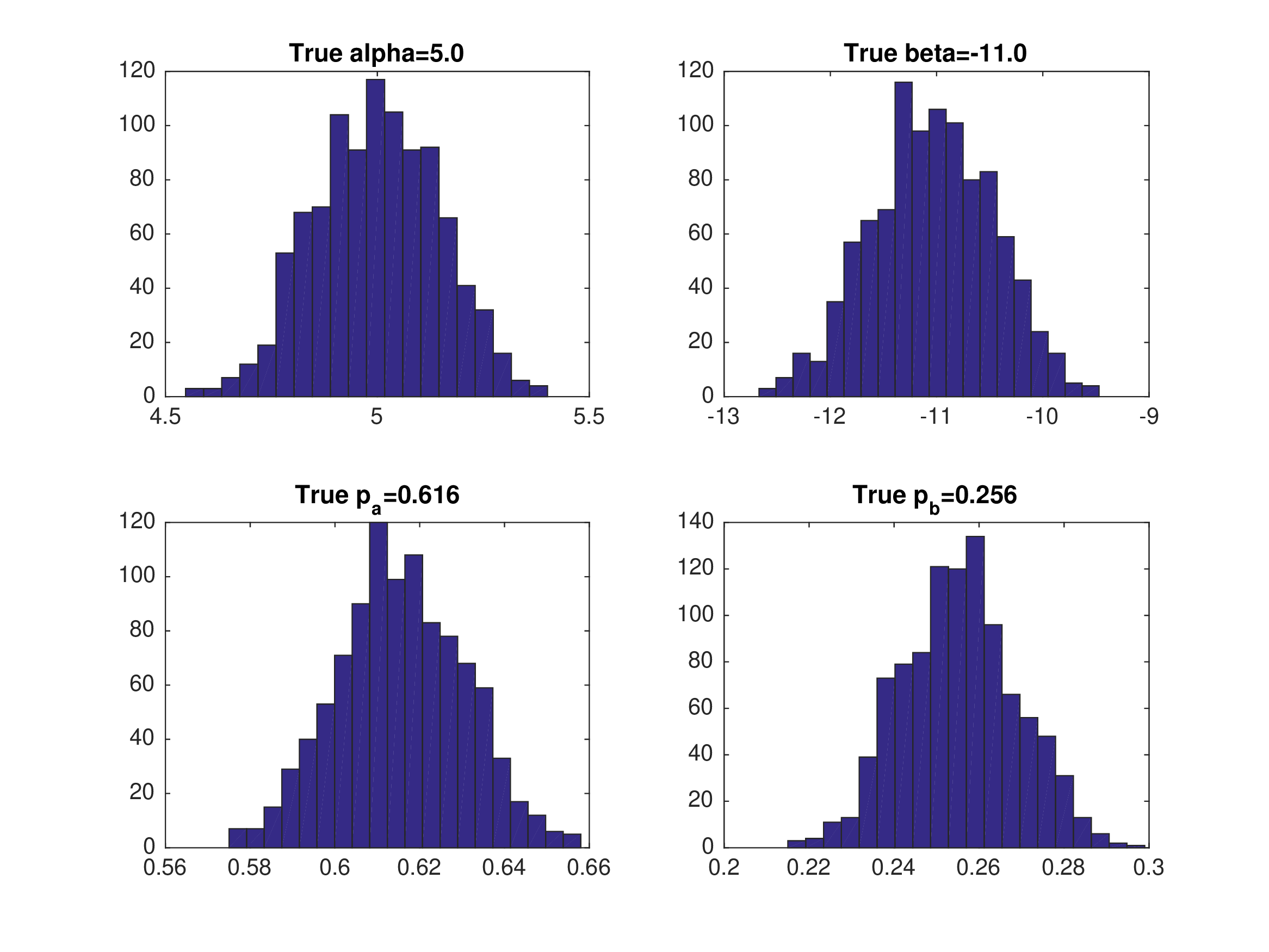

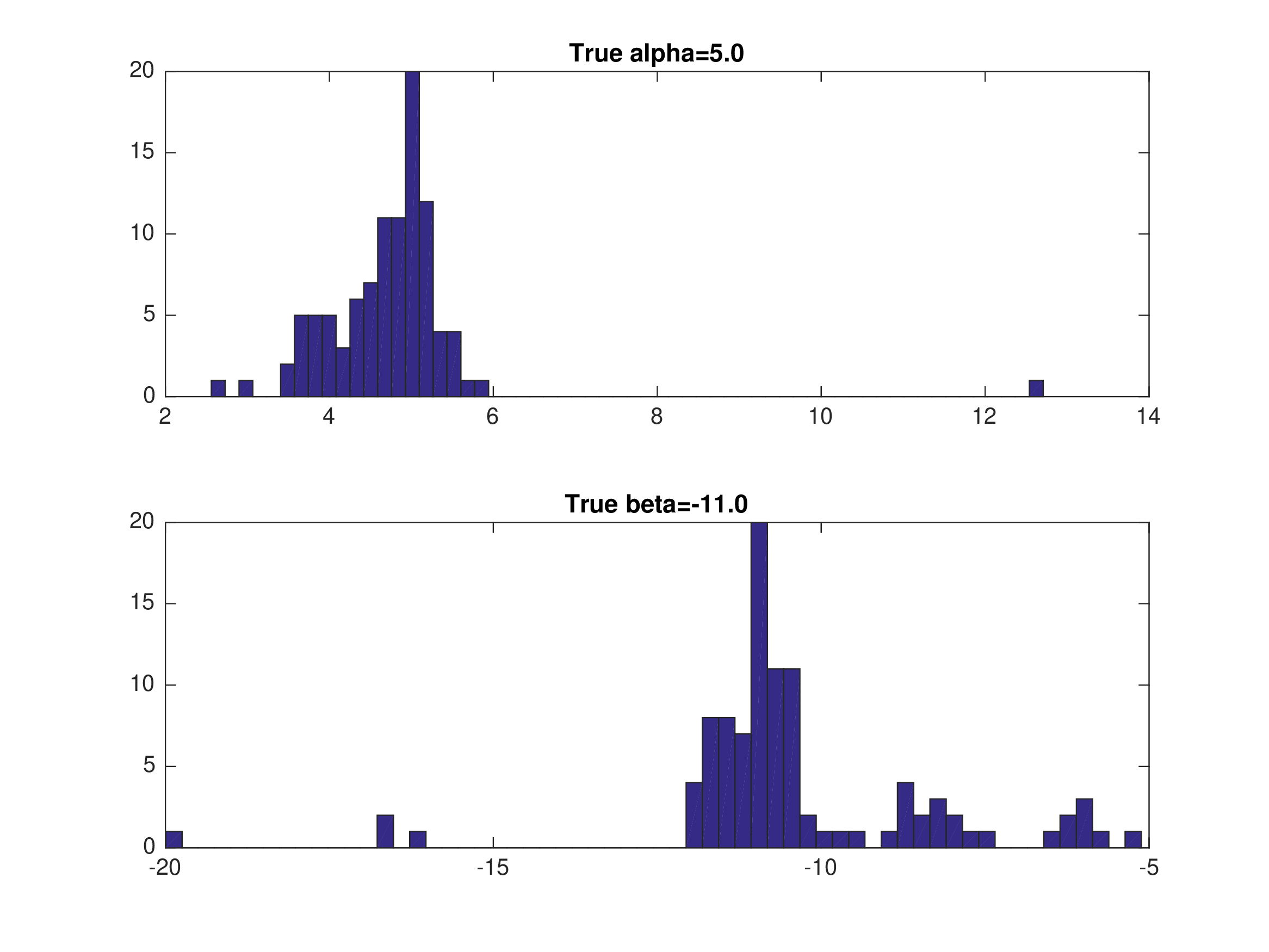

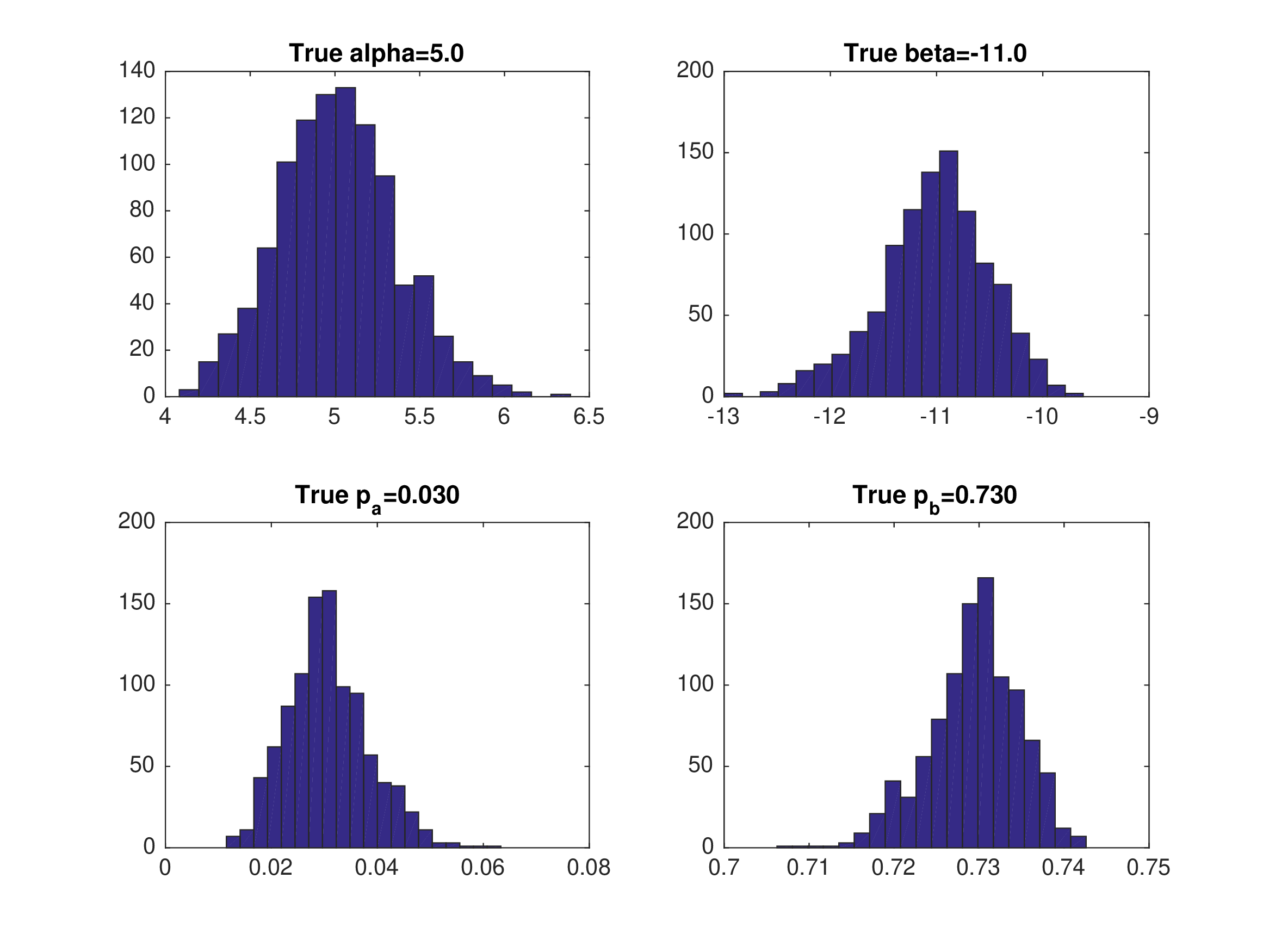

Monte Carlo Results: NFXP with Eq2#

Data generated from equilibrium 2

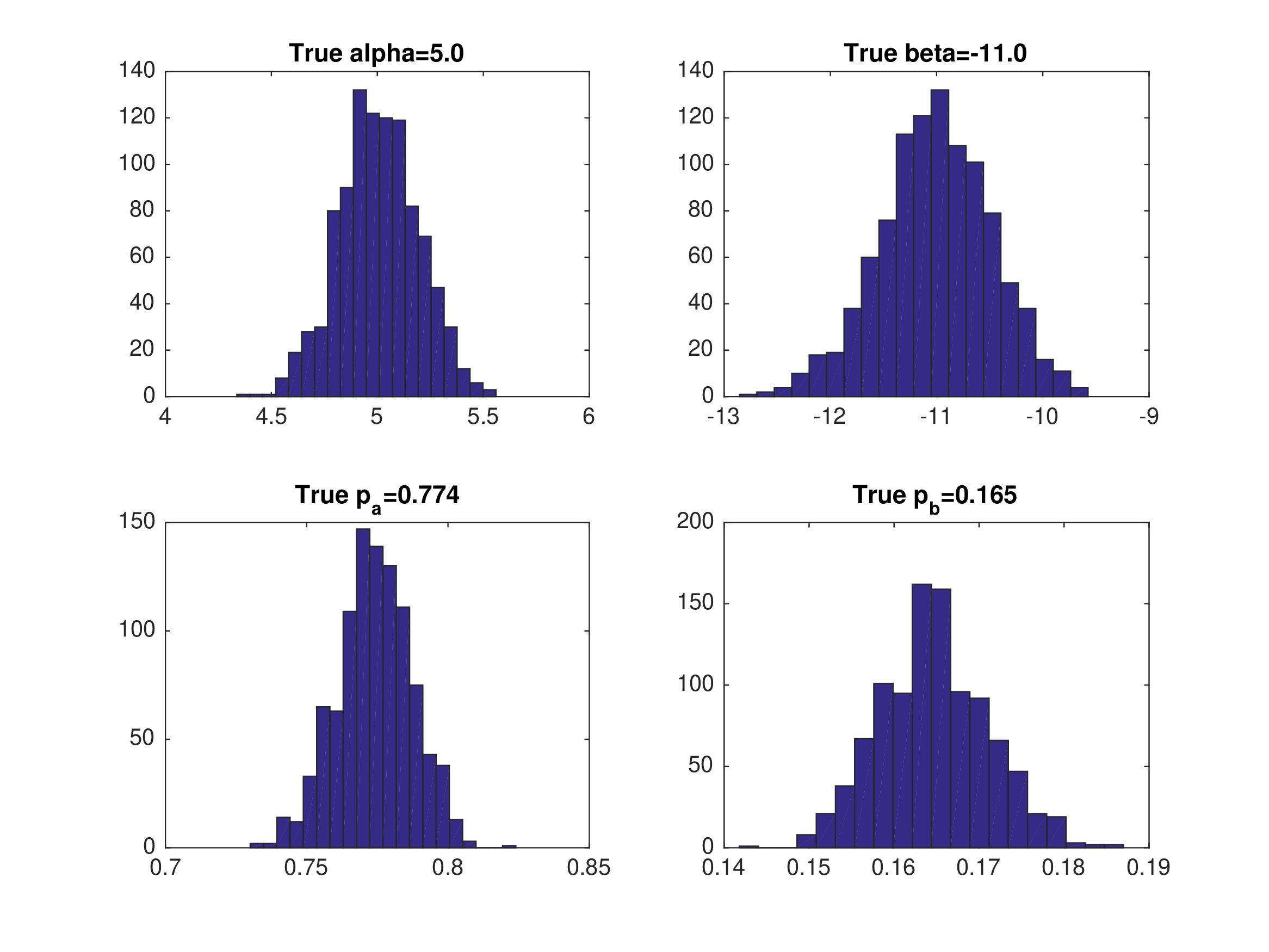

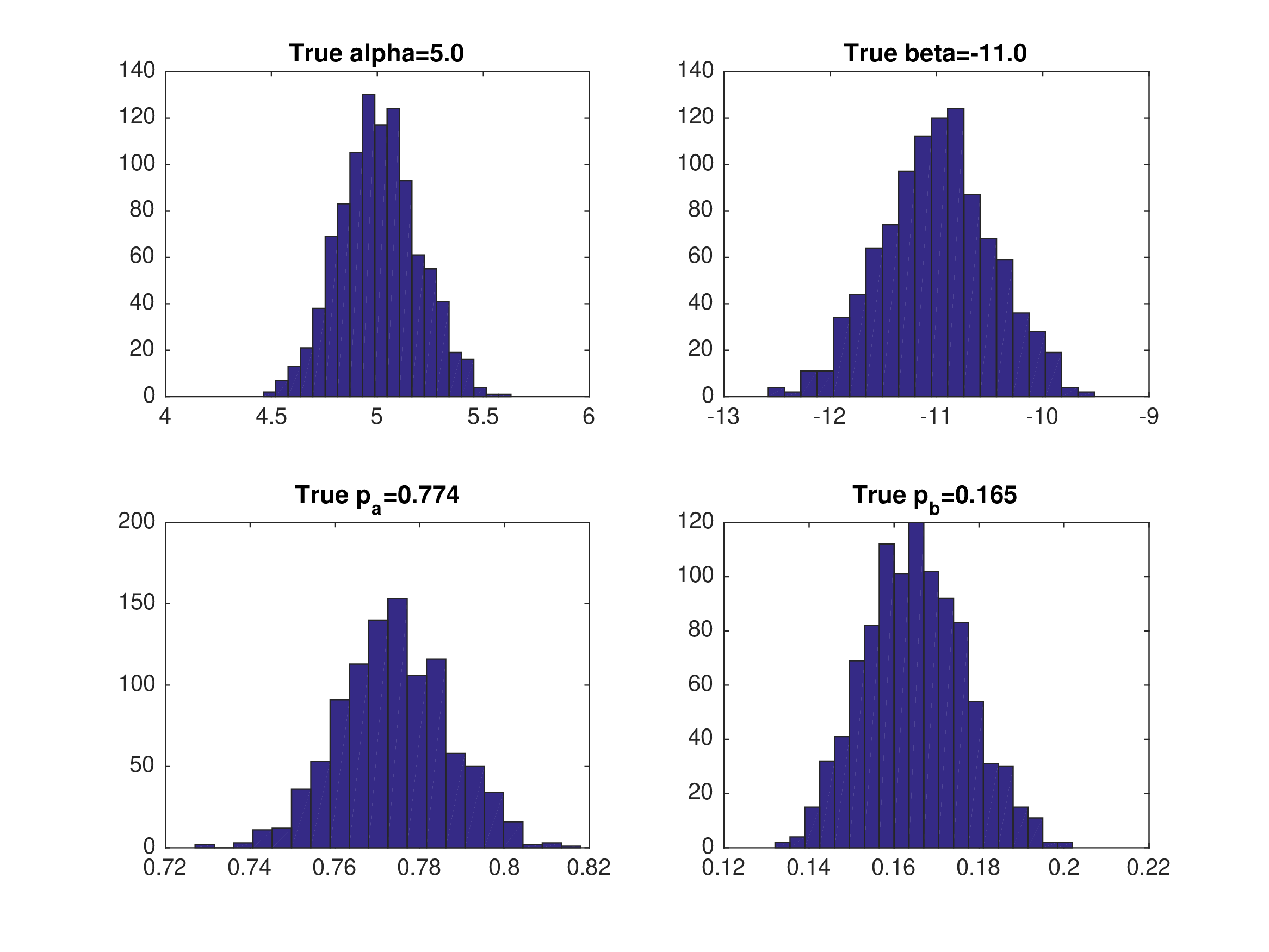

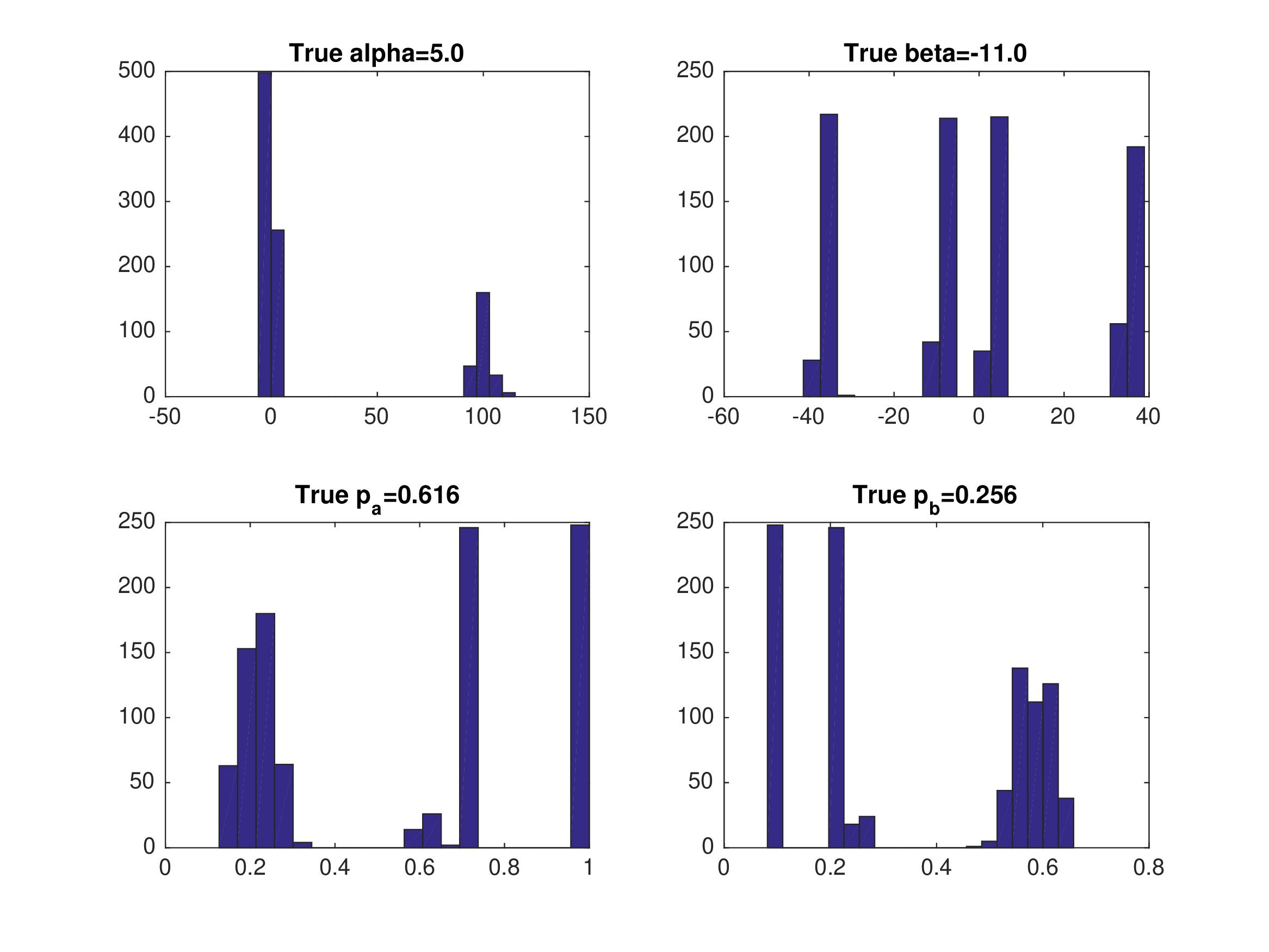

Monte Carlo Results: NFXP with Eq3#

Data generated from equilibrium 3

Mathematical programming with equilibrium constraints (MPEC)#

Constrained Optimization Formulation for Maximum Likelihood Estimation

Maximize the likelihood function:

Subject to BNE constraints:

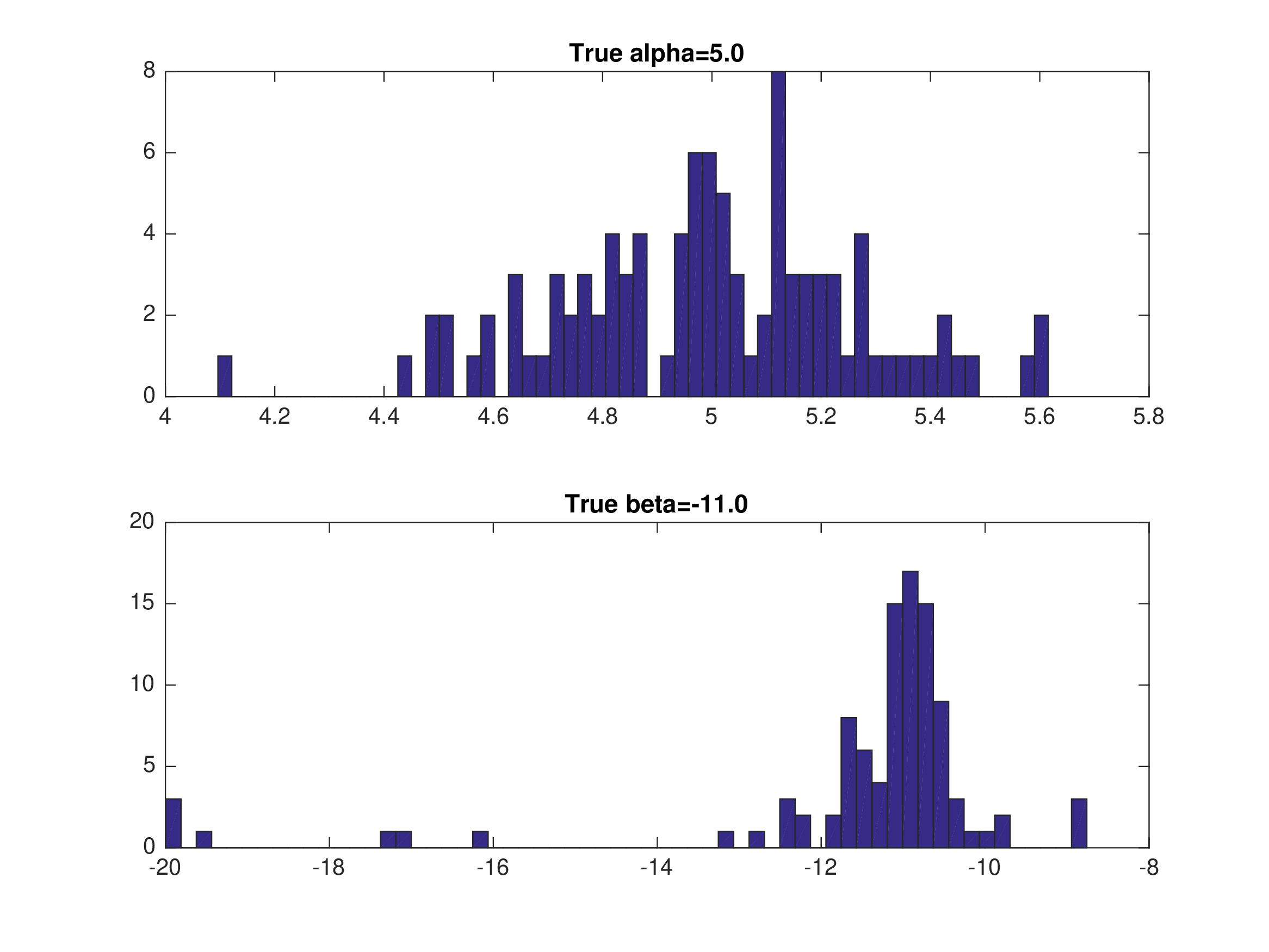

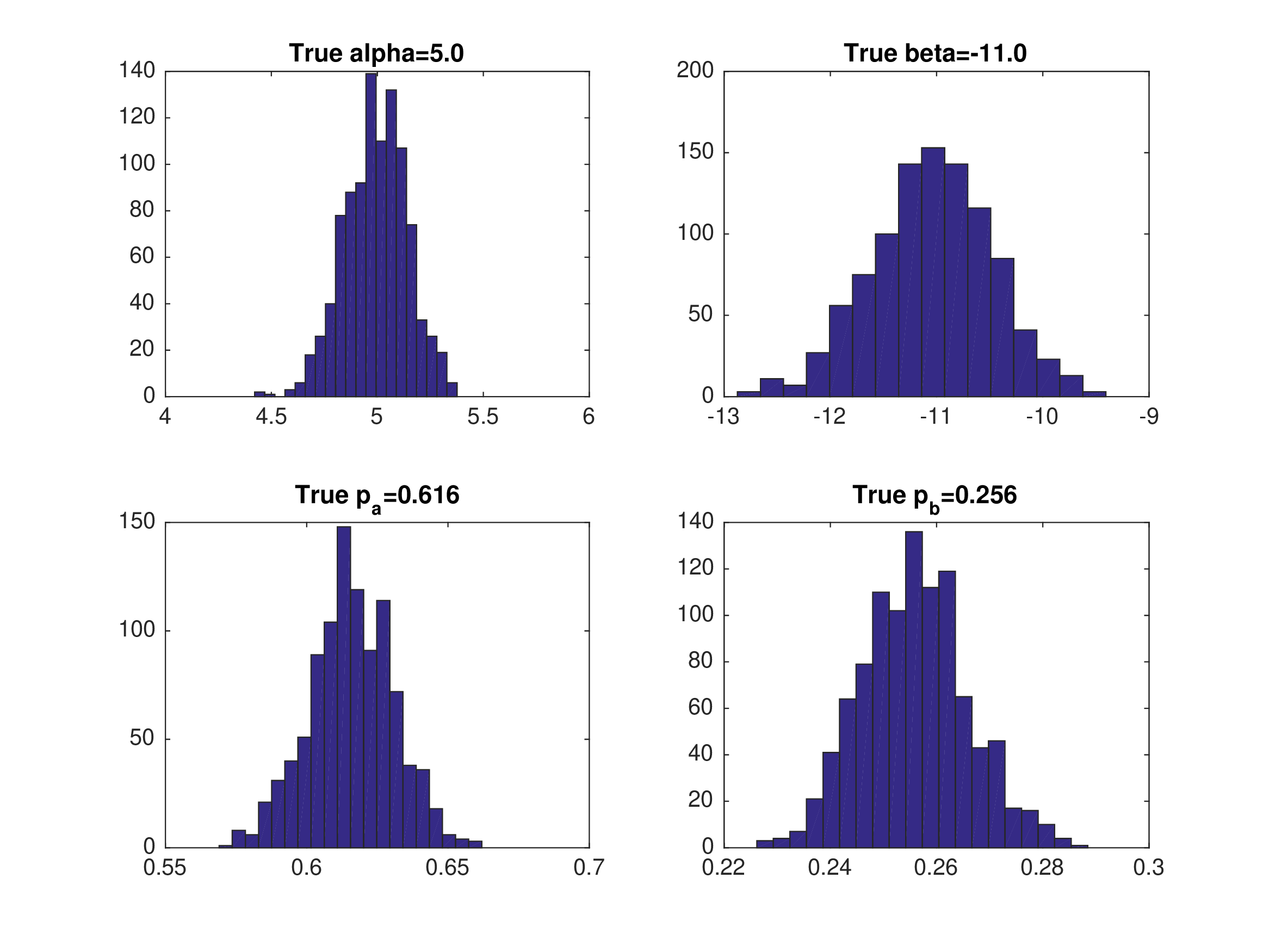

Monte Carlo Results: MPEC with Eq1#

Data generated from equilibrium 1

Monte Carlo Results: MPEC with Eq2#

Data generated from equilibrium 2

Monte Carlo Results: MPEC with Eq3#

Data generated from equilibrium 3

Static Game Example: Maximum Likelihood Estimation (repeat)#

Maximize the likelihood function (as above), with BNE definitions

Discussion

Q: Is the likelihood function smooth in \(\alpha\) and \(\beta\) for NFXP? What about MPEC—are the objective and constraints smooth in \(\theta=(\alpha,\beta,p_a,p_b)\)?

Q: Can we identify which equilibrium is played in the data (equilibrium selection rule)?

Q: Can we use standard theorems for inference? Is the true value interior? Differentiable? Is the objective continuous?

Q: This problem is extremely simple. \(p_a\) and \(p_b\) are scalars. How would you solve for \(p_a\) and \(p_b\) when they are solutions to players’ Bellman equations?

Can we be sure to find all equilibria by iterating on players’ Bellman equations? Why/why not?

Estimation with Multiple Markets#

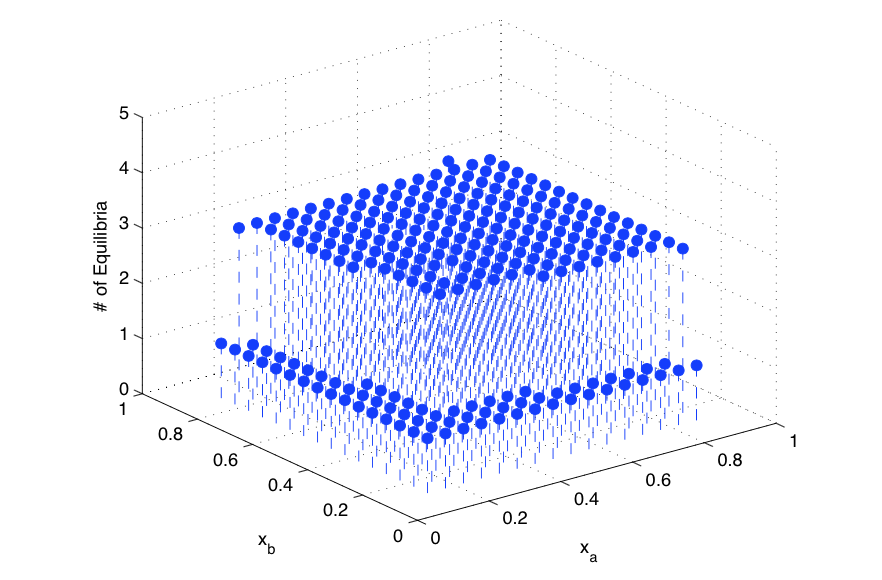

There are 25 different markets, i.e. 25 pairs of observed types \((x^{m}_{a},x^{m}_{b})\), \(m=1,\dots,25\).

The grid on \(x_a\) has 5 points equally distributed in \([0.12,0.87]\); similarly for \(x_b\).

Use the same true parameter values \((\alpha_{0},\beta_{0})\).

For each market \((x^{m}_{a},x^{m}_{b})\), solve BNE for \((p^{m}_{a},p^{m}_{b})\).

There are multiple equilibria in most of the 25 markets.

For each market, randomly choose an equilibrium to generate 1000 data points.

The equilibrium used to generate data can differ across markets (randomized per market).

\(\implies\) # of Equilibria with Different \((x^{m}_{a},x^{m}_{b})\)

NFXP — Estimation with Multiple Markets#

Inner loop:

Outer loop:

For given \((\alpha,\beta)\), solve BNE for all equilibria \(k=1,\dots,K\) in each market \(m=1,\dots,M\):

Choose, in each market, the equilibrium with the highest likelihood:

and set

MPEC - Estimation with Multiple Markets#

Constrained optimization formulation

subject to

MPEC does not explicitly solve the BNE equations to find all equilibria at each market for every trial parameter value.

But the number of optimization variables is much larger.

Both MPEC and NFXP are Full-Information Maximum Likelihood (FIML) estimators.

NFXP: Monte Carlo — Multiple Markets (\(M=25, T=50\))#

Starting values \(\alpha_{0}=\alpha\), \(\beta_{0}=\beta\). Random equilibrium selection across markets.

MPEC: Monte Carlo — Multiple Markets (\(M=25, T=50\))#

Starting values \(\alpha_{0}=\alpha\), \(\beta_{0}=\beta\). Random equilibrium selection across markets.

MPEC: Monte Carlo — Multiple Markets (\(M=2, T=625\))#

Random equilibrium selection in different markets.

NFXP: Monte Carlo — Multiple Markets (\(M=25, T=50\))#

Starting values \(\alpha_{0}=\alpha\), \(\beta_{0}=\beta\). Random equilibrium selection across markets.

MPEC: Monte Carlo — Multiple Markets (\(M=25, T=50\))#

Starting values \(\alpha_{0}=\alpha\), \(\beta_{0}=\beta\). Random equilibrium selection across markets.

MPEC: Monte Carlo — Multiple Markets (\(M=2, T=625\))#

Random equilibrium selection in different markets.

Discussion: NFXP

2 parameters in the optimization problem.

Can identify the equilibrium played in the data, \(p_{a}^{m,k*}\) and \(p_{b}^{m,k*}\)

(but in models with observationally equivalent equilibria this may not be possible).Needs to find all equilibria in each market (very hard in more complex problems).

Good full-solution methods required.

Discussion: MPEC

\(2+2M\) parameters in the optimization problem.

Does not always converge to the equilibrium played in the data, although NFXP may indicate \(p_{a}^{m,k*}\) and \(p_{b}^{m,k*}\) are identifiable.

Local minima with many markets.

Disclaimer: quick and dirty MPEC implementation; prefer AMPL/Knitro.

2-Step CCP-based methods#

Recall the FIML constrained formulation:

subject to

Denote the solution \((\alpha^{*},\beta^{*}, p^{*}_{a}, p^{*}_{b})\).

Suppose \((p^{*}_{a}, p^{*}_{b})\) are known—how to recover \((\alpha^{*},\beta^{*})\)?

2-Step Methods: Recovering \((\alpha^{*},\beta^{*})\)#

Idea 1

Step 1: Estimate \(\hat{p}=(\hat{p}_{a},\hat{p}_{b})\) from the data.

Step 2: Solve the BNE equations for \((\alpha,\beta)\) given \((p^{*}_{a}, p^{*}_{b})\):

Idea 2

Step 1: Estimate \(\hat{p}=(\hat{p}_{a},\hat{p}_{b})\) from the data.

Step 2: Choose \((\alpha,\beta)\) to

2-Step Methods: Potential Issues to Address#

How to estimate \(\hat{p}=(\hat{p}_{a},\hat{p}_{b})\)?

Different methods yield different \(\hat{p}\).

Frequency estimator:

If \((\hat{p}_{a},\hat{p}_{b})\ne (p^{*}_{a},p^{*}_{b})\) then \((\hat{\alpha},\hat{\beta})\ne (\alpha^{*},\beta^{*})\)

For a given \((\hat{p}_{a},\hat{p}_{b})\), a solution to the BNE equations may not exist

Nested and 2-Step Pseudo Maximum Likelihood (NPL)#

In 2-step methods:

Step 1: Estimate \(\hat{p}=(\hat{p}_{a},\hat{p}_{b})\) from the data.

Step 2: Solve

subject to

Equivalently:

Step 1: Estimate \(\hat{p}\).

Step 2: Solve

Least Squares Estimators#

📖 Pesendorfer and Schmidt-Dengler [2008]

Step 1: Estimate \(\hat{p}=(\hat{p}_{a},\hat{p}_{b})\) from the data.

Step 2: Solve

For dynamic games, MPE conditions are \(p=\Psi(p,\theta)\).

Step 1: Estimate \(\hat{p}\) from the data.

Step 2: Solve

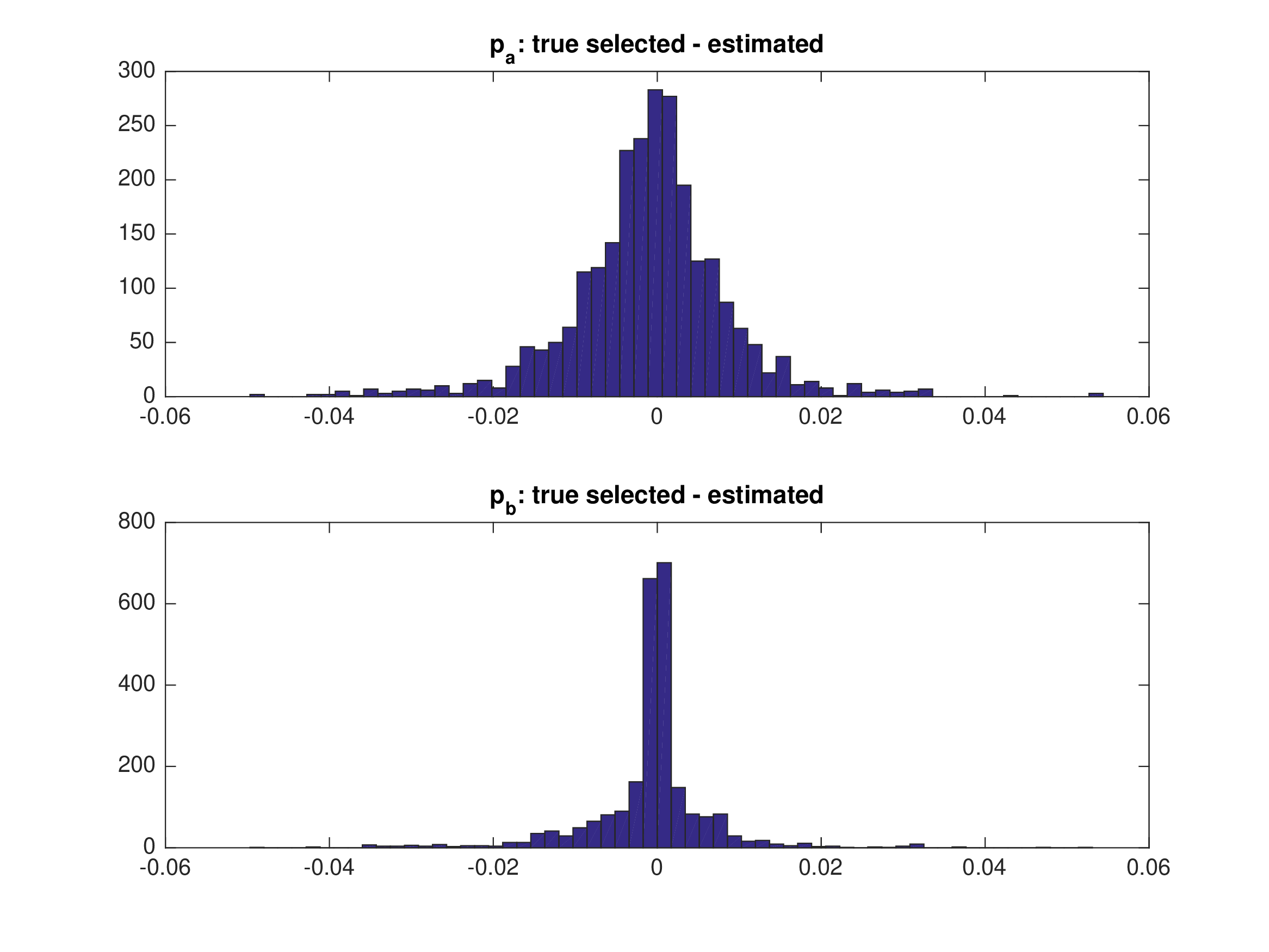

Static Game Example: 2-Step PML (Eq 1)#

Data generated from equilibrium 1

Static Game Example: 2-Step PML (Eq 2)#

Data generated from equilibrium 2

Static Game Example: 2-Step PML (Eq 3)#

Data generated from equilibrium 3

Nested Pseudo Likelihood (NPL):#

📖 Aguirregabiria and Mira [2007]

NPL iterates on the 2-step method:

Step 1: Estimate \(\hat{p}^{0}=(\hat{p}^{0}_{a},\hat{p}^{0}_{b})\) from the data; set \(k=0\).

Step 2: Repeat

Solve

One best-reply iteration on \(\hat{p}^{k}\):

Let \(k\leftarrow k+1\)

Until convergence in \((\alpha^{k},\beta^{k})\) and \((\hat{p}^{k}_{a},\hat{p}^{k}_{b})\).

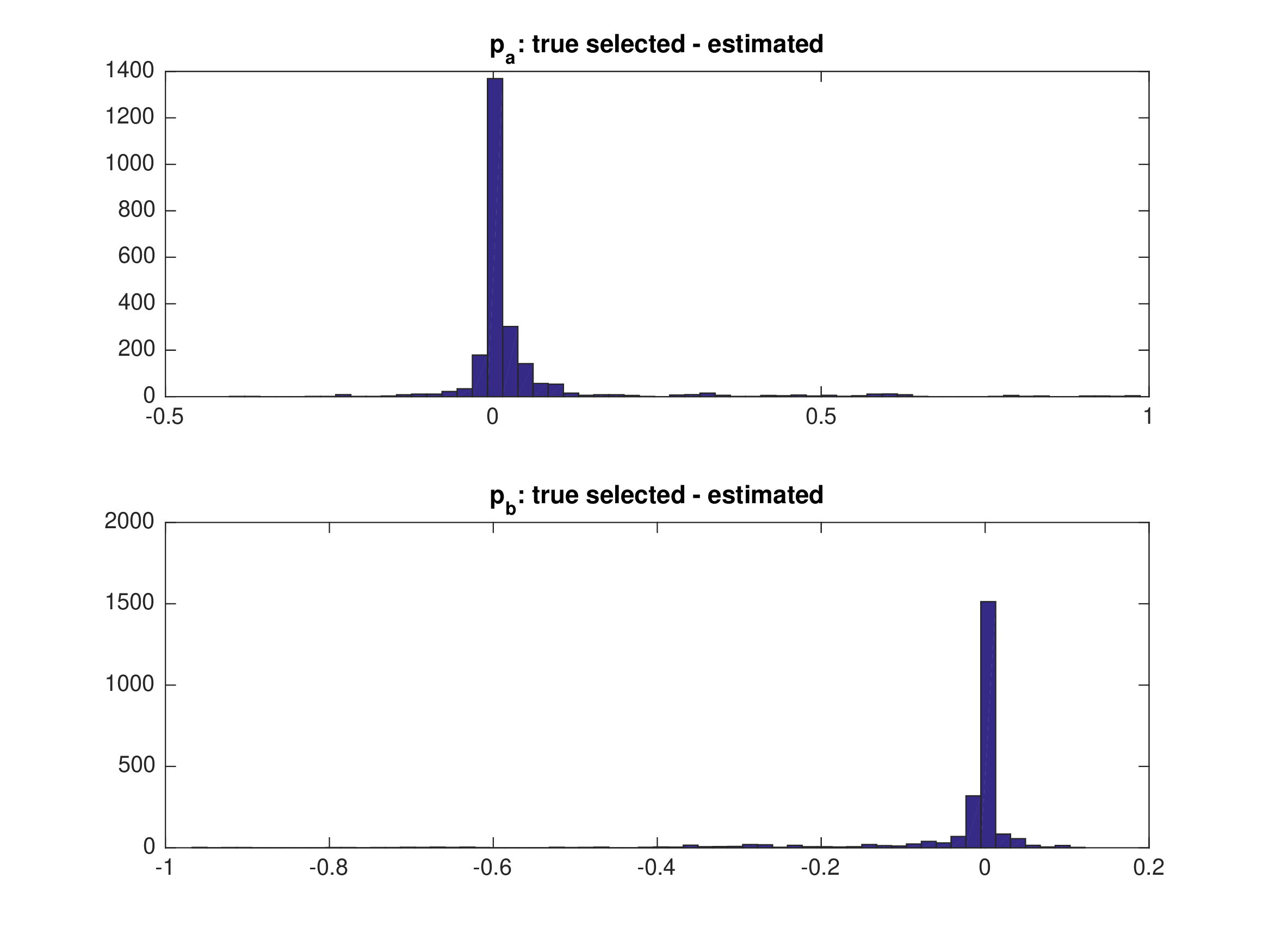

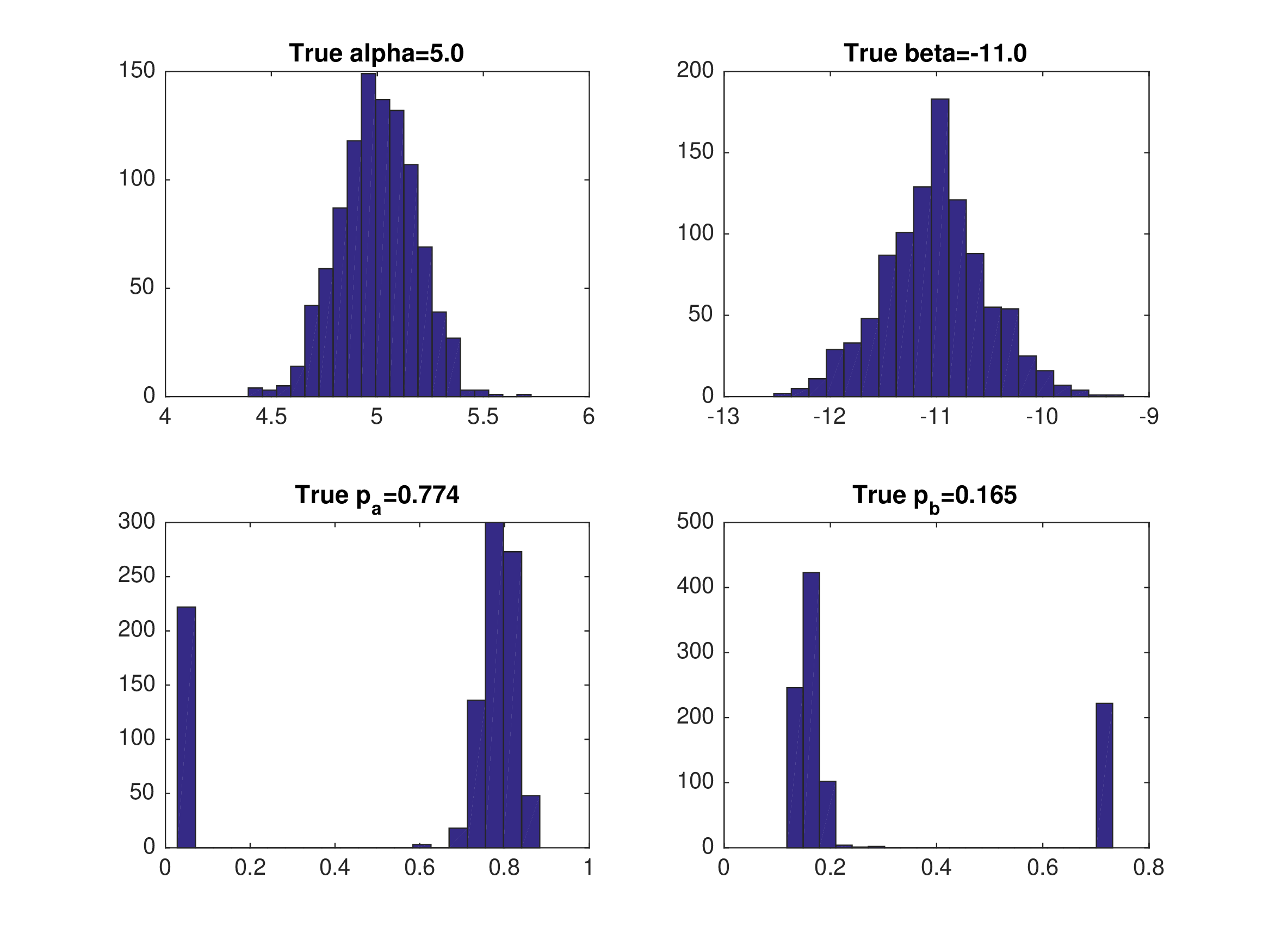

Monte Carlo Results: NPL with Eq 1#

Equilibrium 1 — \(\hat{p}_{j}=\frac{1}{N}\sum_{i}\mathbf{1}(d_{j}=1)\)

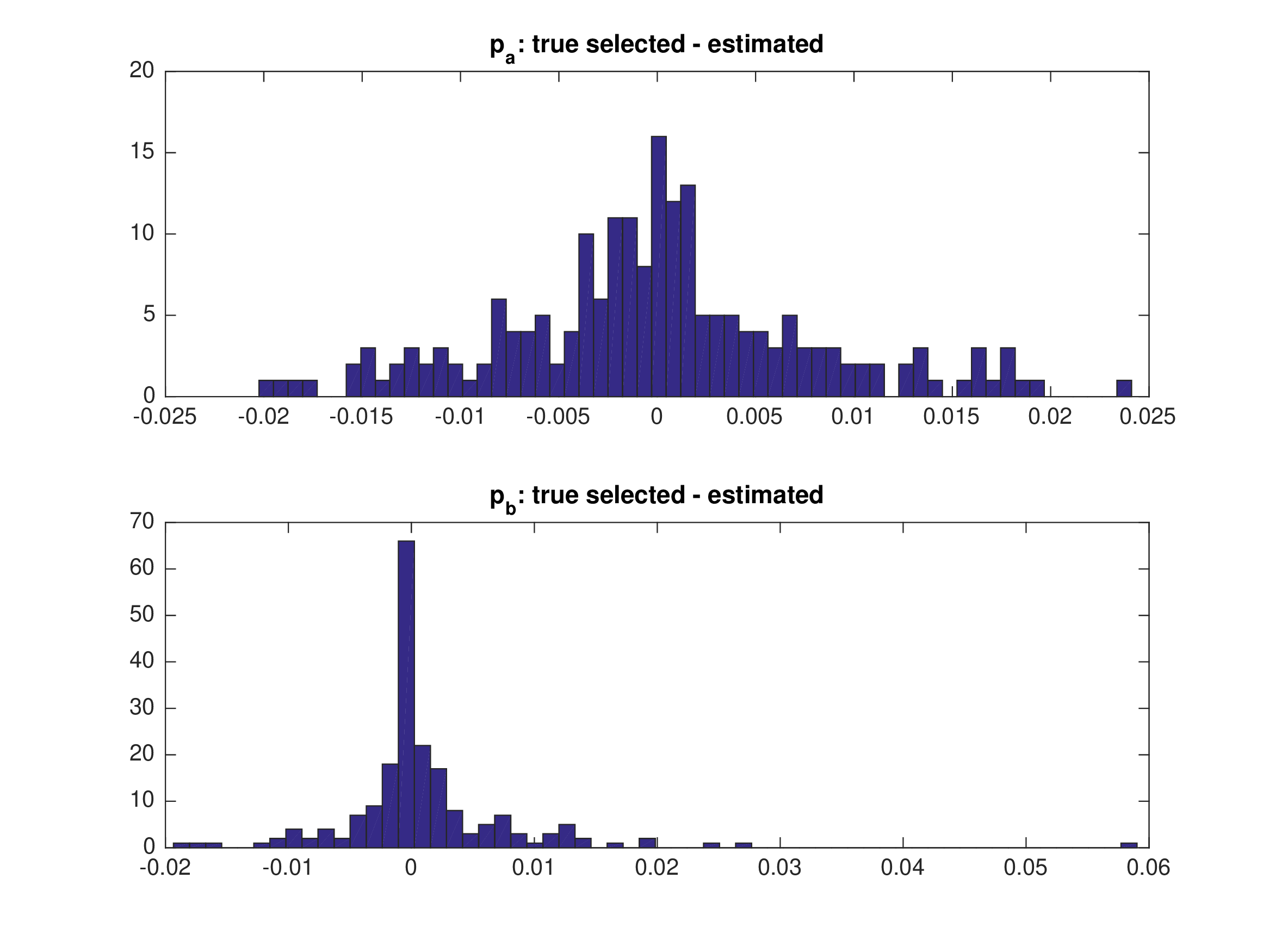

Monte Carlo Results: NPL with Eq 2#

Equilibrium 2 — \(\hat{p}_{j}=\frac{1}{N}\sum_{i}\mathbf{1}(d_{j}=1)\)

Monte Carlo Results: NPL with Eq 3#

Equilibrium 3 — \(\hat{p}_{j}=\frac{1}{N}\sum_{i}\mathbf{1}(d_{j}=1)\)

Conclusions#

NFXP/MPEC implementations of MLE are statistically efficient but computationally daunting.

Two-step estimators are computationally fast, but inefficient and biased in small samples.

NPL (Aguirregabiria and Mira 2007) aims to bridge the gap, but may be unsuitable for games with multiple equilibria.

Estimating even static games is an interesting yet challenging computational optimization problem:

Multiple equilibria can make the likelihood function discontinuous \(\rightarrow\) non-standard inference and computational complexity.

Multiple equilibria lead to indeterminacy and identification issues.

All these problems are amplified in dynamic models.

Practical Task 7.3

Find full Matlab implementation of Su(2014) static model

Study the code to identify the parts that correspond to the lecture notes

Identify where different estimators are implemented

[otpional] Convert Matlab code to Python

Find the exercise code and materials in the exercises repo in the forlder 7_multiplicity/matlab_sgame